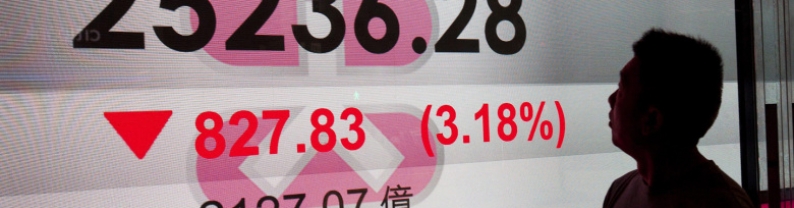

Hong Kong stocks were back in the red Friday as markets digested news of a softening U.S. job market and an unexpected decline in China's export figures. The Hang Seng Index decreased by around 244.07 points, or roughly 0.9%, to end at 26,241.83. The Hang Seng China Enterprises Index fell around 88.41 points, or 0.9%, to 9,267.56. China's exports in October slipped 1.1% year on year in US dollar terms to $305.4 billion, missing a consensus estimate of a 2.9% increase, according to a Bloomberg survey, the South China Morning Post reported. The contraction could signal a worsening outlook...

The Japanese Yen (JPY) struggles near a three-week low against its American counterpart during the Asian session on Tuesday and seems vulnerable to prolonging a two-week-old downtrend. US President Donald Trump showed willingness to engage in trade negotiations, fueling hopes for a US-Japan deal before the August 1 deadline and lending some support to the JPY. Meanwhile, the optimism boosts investors' appetite for riskier assets and acts as a headwind for the safe-haven JPY. Furthermore, bets that the Bank of Japan (BoJ) would keep interest rates low for longer than it wants amid concerns...

The Australian dollar edged higher to around $0.654 on Tuesday, following a notable decline in the previous session, largely driven by renewed optimism over US President Donald Trump's willingness to further engage in trade discussions. Despite maintaining a firm stance on the upcoming 30% tariffs set to take effect on August 1, Trump indicated a readiness to resume negotiations with the European Union and other major trading partners, hinting at a potential diplomatic opening and easing investor fears of a deepening trade conflict. Domestically, sentiment was further buoyed by positive...

The US dollar index held above 98 on Tuesday, hovering near a three-week high as investors awaited the June consumer inflation report that could provide clues on how the Trump administration's tariffs have been affecting prices. Federal Reserve Chair Jerome Powell recently indicated that inflation is expected to rise over the summer due to tariff pressures, reinforcing expectations that the Fed may delay interest rate cuts until later this year. Meanwhile, concerns over central bank independence resurfaced as President Donald Trump renewed criticism of Powell, arguing that interest rates...

Gold edges higher in the early Asian session. Key development is today's release of U.S. CPI, XS.com's Rania Gule says in an email. "Inflation remains the core variable steering the Fed's monetary policy, and therefore directly impacts market sentiment toward safe-haven or risk-on assets," the senior market analyst says. Should inflation be hotter than expected, expectations of a Fed rate cut in September may be scaled back, strengthening USD and putting downward pressure on gold. On the other hand, weak inflation readings would boost the case for Fed rate cuts and be strongly supportive of...

Oil held a drop after slumping by more than 2% on Monday as US President Donald Trump's latest plan to pressure Russia refrained from immediate new measures aimed at hindering Moscow's energy exports. US benchmark West Texas Intermediate traded near $67 a barrel, while Brent settled near $69 in the previous session. Trump boosted military support for Ukraine to resist Moscow's invasion, and threatened to impose 100% tariffs if the hostilities did not end with a deal in 50 days. The planned action effectively represents secondary sanctions on countries buying oil from Russia, according...