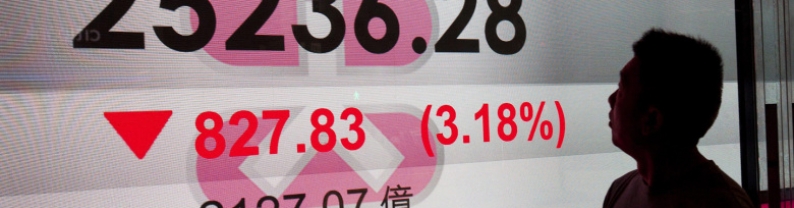

Hong Kong stocks were back in the red Friday as markets digested news of a softening U.S. job market and an unexpected decline in China's export figures. The Hang Seng Index decreased by around 244.07 points, or roughly 0.9%, to end at 26,241.83. The Hang Seng China Enterprises Index fell around 88.41 points, or 0.9%, to 9,267.56. China's exports in October slipped 1.1% year on year in US dollar terms to $305.4 billion, missing a consensus estimate of a 2.9% increase, according to a Bloomberg survey, the South China Morning Post reported. The contraction could signal a worsening outlook...

Gold prices rose on Tuesday (July 15th) as concerns over a global trade war fueled demand for safe-haven assets, while investors awaited key US inflation data. Spot gold rose 0.5% to $3,361.39 per ounce, as of 08:16 GMT. US gold futures rose 0.3% to $3,370.40. The US dollar (.DXY), opened in a new tab, fell 0.1%, making gold cheaper for buyers holding other currencies. "Gold strengthened as bullish investors looked to capitalize on the slightly weaker dollar today," said Han Tan, chief market analyst at Nemo.Money. "Gold is enjoying a multitude of supporting factors, ranging from...

Silver prices (XAG/USD) recovered from their latest decline from the previous session, rebounding toward a 14-year high of $39.13, reached on Monday (July 15th), and traded around $38.40 per troy ounce during the European session on Tuesday. Silver prices strengthened as traders remained cautious ahead of the June US Consumer Price Index (CPI) data, which may provide fresh insight into the Federal Reserve's monetary outlook. Silver attracted sellers as Federal Reserve Chairman Jerome Powell indicated that inflation is expected to rise over the summer, driven by tariff-related pressures....

The dollar traded in a tight range ahead of key US inflation data that may influence monetary policy and shape discussions around Federal Reserve leadership. The Bloomberg Dollar Spot Index edged down 0.1% Dollar-yen was sold on fix flows and in view of Japan's 10-year government bond yield touching the highest level since 2008, according to an Asia-based FX trader Commodity currencies edged higher after data show China's economic growth exceeded expectations in the second quarter, with gross domestic product expanding 5.2% in April-June from a year...

Oil prices fell on Tuesday after U.S. President Donald Trump's lengthy 50-day deadline for Russia to end the Ukraine war and avoid sanctions eased immediate supply concerns. Brent crude futures fell 29 cents, or 0.4%, to $68.92 a barrel by 0342 GMT, while U.S. West Texas Intermediate crude futures fell 35 cents, or 0.5%, to $66.63. Both contracts settled more than $1 lower in the previous session. "Trump's milder stance on sanctions over Russian oil eased fears of a supply crunch while his tariff plan continues to mount economic pressures," said Priyanka Sachdeva, senior market analyst at...

The USD/CHF pair trades on a negative note near 0.7965 during the early European session on Tuesday. Persistent trade-related uncertainties and geopolitical risks boost the safe-haven flows, supporting the Swiss Franc (CHF). The US consumer inflation figures will take center stage later on Tuesday. Bloomberg reported late Monday that US President Donald Trump threatened to impose 100% tariffs on Russia if President Vladimir Putin does not agree to a deal to end his invasion of Ukraine in 50 days. Trump further stated that the levies would come in the form of secondary tariffs, without...