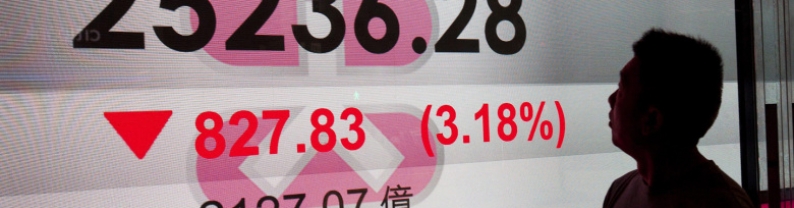

Hong Kong stocks were back in the red Friday as markets digested news of a softening U.S. job market and an unexpected decline in China's export figures. The Hang Seng Index decreased by around 244.07 points, or roughly 0.9%, to end at 26,241.83. The Hang Seng China Enterprises Index fell around 88.41 points, or 0.9%, to 9,267.56. China's exports in October slipped 1.1% year on year in US dollar terms to $305.4 billion, missing a consensus estimate of a 2.9% increase, according to a Bloomberg survey, the South China Morning Post reported. The contraction could signal a worsening outlook...

Gold edged higher after a slew of tariff-related announcements from President Donald Trump signaled concerns over the impact of a potential global trade war remain, giving support to the haven asset. Bullion ticked up to about $3,330 an ounce after closing 0.6% lower on Tuesday. Trump said he had reached a deal with Indonesia, imposing 19% tariff on country. The president also said levies on pharmaceuticals were likely as soon as the end of the month, while rates on semiconductors were also looming. Meanwhile, the US opened an investigation into Brazil about its "unfair" trade...

West Texas Intermediate (WTI), the US crude oil benchmark, is trading around $65.70 during the early Asian trading hours on Wednesday. The WTI price edges lower amid easing concerns about supply disruption after US President Donald Trump gives a 50-day deadline for Russia to end the war in Ukraine. Trump late Monday announced new weapons for Ukraine and threatened sanctions on buyers of Russian exports unless Russia agrees to a peace deal in 50 days. The WTI price loses ground as the 50-day deadline raises hopes that sanctions could be avoided. US crude oil inventory unexpectedly rose last...

Gold price tumbled on Tuesday, down more than 0.40% following the release of the latest inflation report in the United States (US), which boosted the US Dollar to the detriment of the precious metal. Comments by US President Donald Trump and risk aversion, instead of driving Bullion prices higher, weighed on the precious metal, which trades at $3,329 after hitting a daily peak of $3,366. The market mood is mixed, with US equities fluctuating between gains and losses following the release of the June Consumer Price Index (CPI). Headline and core figures on an annual basis rose, signaling...

The Australian Dollar (AUD) weakened further against the US Dollar (USD) on Tuesday following the release of US inflation data that dampened hopes for a near-term interest rate cut. The Greenback surged across the board, pushing AUD/USD to 0.6510 during the American trading session. US Consumer Price Index (CPI) rose 0.3% in June from the previous month, slightly above the 0.2% consensusand 2.7% YoY, surpassing May's 2.4% print. It marked the fastest pace since January and signaled that underlying price pressures remain sticky despite the Fed's tightening efforts. The data prompted a sharp...

The Swiss Franc (CHF) weakens against the US Dollar (USD) on Tuesday, as traders flock to the Greenback in response to hotter-than-expected US inflation data. The Consumer Price Index (CPI) figures reignited bets that the Federal Reserve may delay its first interest rate cut, boosting US Treasury yields and driving broad-based demand for the US Dollar, with USD/CHF climbing above the 0.8000 mark for the first time since late June. At the time of writing, the USD/CHF pair is trading near 0.8021, up over 0.50% on the day. The latest US inflation data showed that prices continued to rise in...