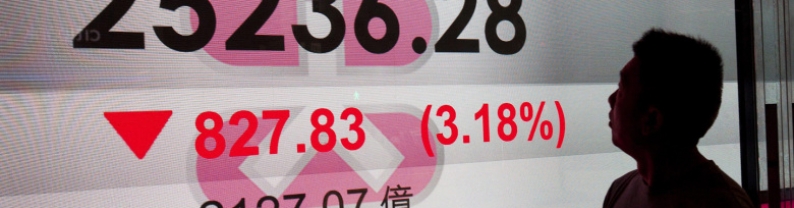

Hong Kong stocks were back in the red Friday as markets digested news of a softening U.S. job market and an unexpected decline in China's export figures. The Hang Seng Index decreased by around 244.07 points, or roughly 0.9%, to end at 26,241.83. The Hang Seng China Enterprises Index fell around 88.41 points, or 0.9%, to 9,267.56. China's exports in October slipped 1.1% year on year in US dollar terms to $305.4 billion, missing a consensus estimate of a 2.9% increase, according to a Bloomberg survey, the South China Morning Post reported. The contraction could signal a worsening outlook...

The GBP/USD pair consolidates near the 1.3430-1.3435 region, just above a three-week low touched during the Asian session on Tuesday as traders keenly await the release of the US consumer inflation figure. Meanwhile, the fundamental backdrop seems tilted in favor of bears and suggests that the path of least resistance for spot prices is to the downside. The disappointing macro data released from the UK last week reinforced bets that the Bank of England (BoE) could cut interest rates again in August. This marks a significant divergence in comparison to diminishing odds for an immediate rate...

Gold inched higher on Tuesday, ahead of the release of U.S. inflation data later in the day that could shed more light on the Federal Reserve's interest rate path. Spot gold was up 0.1% at $3,346.94 per ounce, as of 0151 GMT. U.S. gold futures were flat at $3,355.60. "Gold has shown in the past that it is an asset of choice when tariff tensions are ratcheted up, and the precious metal's move towards $3,350 is evidence of this pattern playing out again," KCM Trade Chief Market Analyst Tim Waterer said. "However, higher treasury yields and USD appreciation have created headwinds...For gold...

Oil prices edged lower in Asian trade on Tuesday as markets weighed U.S. President Donald Trump's 50-day ultimatum for Russia to end the Ukraine war and threats of sanctions on buyers of its oil. Traders also digested a flurry of Chinese economic data on Tuesday, including second-quarter GDP, industrial production, retail sales, and other key indicators. As of 21:56 ET (01:56 GMT), Brent oil futures expiring in September ticked down 0.2% to $69.06 per barrel, while West Texas Intermediate (WTI) crude futures fell 0.3% to $66.79 per barrel. After an initial rally, oil prices closed nearly...

The Japanese Yen (JPY) struggles near a three-week low against its American counterpart during the Asian session on Tuesday and seems vulnerable to prolonging a two-week-old downtrend. US President Donald Trump showed willingness to engage in trade negotiations, fueling hopes for a US-Japan deal before the August 1 deadline and lending some support to the JPY. Meanwhile, the optimism boosts investors' appetite for riskier assets and acts as a headwind for the safe-haven JPY. Furthermore, bets that the Bank of Japan (BoJ) would keep interest rates low for longer than it wants amid concerns...

The Australian dollar edged higher to around $0.654 on Tuesday, following a notable decline in the previous session, largely driven by renewed optimism over US President Donald Trump's willingness to further engage in trade discussions. Despite maintaining a firm stance on the upcoming 30% tariffs set to take effect on August 1, Trump indicated a readiness to resume negotiations with the European Union and other major trading partners, hinting at a potential diplomatic opening and easing investor fears of a deepening trade conflict. Domestically, sentiment was further buoyed by positive...