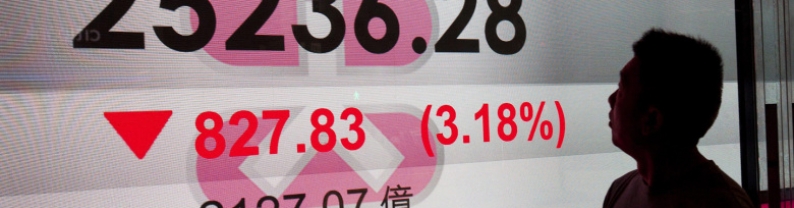

Hong Kong stocks were back in the red Friday as markets digested news of a softening U.S. job market and an unexpected decline in China's export figures. The Hang Seng Index decreased by around 244.07 points, or roughly 0.9%, to end at 26,241.83. The Hang Seng China Enterprises Index fell around 88.41 points, or 0.9%, to 9,267.56. China's exports in October slipped 1.1% year on year in US dollar terms to $305.4 billion, missing a consensus estimate of a 2.9% increase, according to a Bloomberg survey, the South China Morning Post reported. The contraction could signal a worsening outlook...

The US dollar index initially dipped but later rebounded to trade above 98.4 on Tuesday, as the CPI report did little to shift market expectations regarding the Fed's next policy moves. Headline inflation rose in line with expectations on both an annual and monthly basis, while core inflation came in softer than forecast, suggesting price pressures, particularly those stemming from recently imposed tariffs, were limited for now. Following the data, traders modestly increased their expectations for interest rate cuts, but markets are still pricing in two reductions in the federal funds rate...

Gold prices weakened slightly on Tuesday (July 15th) as market participants awaited tariff updates, while inflation reports showed a long-anticipated increase in US consumer prices last month. Spot gold prices fell 0.2% to $3,336.99 an ounce, as of 9:40 a.m. EDT (1:40 p.m. GMT). US gold futures fell 0.4% to $3,345. The US dollar strengthened 0.2%, making gold more expensive for holders of other currencies. "I think the market continues to focus on tariffs, which is keeping gold strong. I remain bullish on gold, even though we're in the range that's been in place since mid-May," said Peter...

Oil prices were little changed on Tuesday (July 15) after U.S. President Donald Trump's lengthy 50-day deadline for Russia to end its war in Ukraine and avoid sanctions eased immediate supply concerns. Brent crude rose 1 cent to $69.22 a barrel at 12:01 GMT. U.S. West Texas Intermediate crude fell 7 cents to $66.91. "The focus is on Donald Trump. There were concerns he might soon impose sanctions on Russia, and now he's given another 50 days," said UBS commodities analyst Giovanni Staunovo. "Concerns about imminent additional tightening in the market have eased. That's the main news." Oil...

The US dollar (USD) traded slightly weaker on Tuesday (July 15th) as investors prepared for the highly anticipated release of the US Consumer Price Index (CPI). With market participants repositioning ahead of key inflation data, the greenback struggled to maintain its gains from the previous day. The US Dollar Index (DXY) traded slightly lower, holding near the psychological 98.00 level during the European session. Although the index remains supported, it faces key technical resistance at current levels, preventing traders from placing aggressive bets. The broader market mood remains...

Oil prices plummeted on Tuesday (July 15) after U.S. President Donald Trump's lengthy 50-day deadline for Russia to end its war in Ukraine and avoid sanctions eased existing supply concerns. Brent crude futures fell 56 cents, or 0.8%, to $68.65 a barrel at 07:36 GMT, while U.S. West Texas Intermediate crude fell 62 cents, or 0.9%, to $66.36. "The focus was on Donald Trump, there were concerns he might soon impose sanctions on Russia, and now he's given another 50 days," said Giovanni Staunovo, a commodities analyst at UBS. "Concerns about imminent additional tightening in the market have...