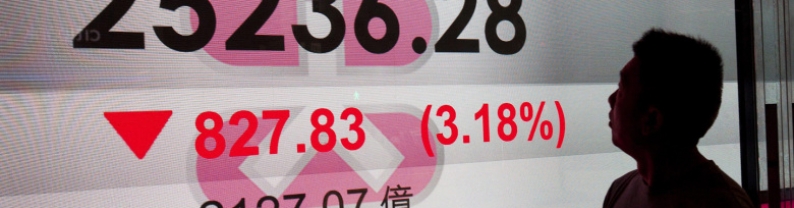

Hong Kong stocks were back in the red Friday as markets digested news of a softening U.S. job market and an unexpected decline in China's export figures. The Hang Seng Index decreased by around 244.07 points, or roughly 0.9%, to end at 26,241.83. The Hang Seng China Enterprises Index fell around 88.41 points, or 0.9%, to 9,267.56. China's exports in October slipped 1.1% year on year in US dollar terms to $305.4 billion, missing a consensus estimate of a 2.9% increase, according to a Bloomberg survey, the South China Morning Post reported. The contraction could signal a worsening outlook...

The EUR/USD remains pressured during the North American session, below the 1.1700 figure as the Dollar got boosted by Trump unveiling new tariff letters on two of its largest trade partners, increasing appetite for haven assets. At the time of writing, the pair trades at 1.1667, down 0.15%. US President Donald Trump revealed levies of 30% on the European Union (EU) and Mexico last weekend. Initially, investors' sentiment deteriorated, but traders seem to be fading from Trump's decision, amid speculation that Washington could backpedal on trade decisions. Analysts cited by Reuters revealed...

Silver retreated from a nearly 14-year high as the dollar pushed higher after US President Donald Trump escalated trade tensions on the European Union and Mexico, the world's top producer of the white metal. Spot silver slipped as much as 0.8% as the greenback advanced during US trading hours. The precious metal is priced in US currency, so the strength in the dollar makes it less attractive for foreign investors. Trump unleashed tariff threats this weekend, declaring a 30% rate for Mexico and the EU, and informing key trading partners of new rates that will kick in on Aug. 1 if...

Oil prices edged lower on Monday, as investors weighed new threats from U.S. President Donald Trump for sanctions on buyers of Russian oil that may affect global supplies, while still worried about Trump's tariffs. Brent crude futures fell 79 cents, or 1.12%, to $69.57 a barrel by 1:04 pm EDT (1704 GMT). U.S. West Texas Intermediate crude futures were down $1.07, also 1.56%, to $67.38. Trump announced new weapons for Ukraine and threatened to hit buyers of Russian exports with sanctions unless Russia agrees to a peace deal in 50 days. Oil prices rallied early, on expectations that...

Gold (XAU/USD) is trading between $3,340 and $3,370 on Monday in response to news that the US may impose a 30% tariff on imports from the European Union (EU) and Mexico, effective August 1. The latest tariff threats on two of America's largest trading partners have provided a tailwind for XAU/USD. At the time of writing, the Gold price is trading near $3,350 as bulls struggle to gain the momentum above $3,370. European Commission President Ursula von der Leyen and Mexican President Claudia Sheinbaum received letters from US President Donald Trump on Saturday. His remarks fueled fears of a...

The US Dollar Index (DXY), which measures the strength of the US Dollar (USD) against a basket of major currencies, remains under pressure at the start of the week, trading below the 98.00 level on Monday. Fresh geopolitical risks have emerged after US President Donald Trump's announcement of tariff threats against the European Union (EU) and Mexico over the weekend. At the same time, reports that President Trump is pressuring Federal Reserve (Fed) Chair Jerome Powell to resign have reignited concerns about the central bank's independence, a factor that may influence investor confidence...