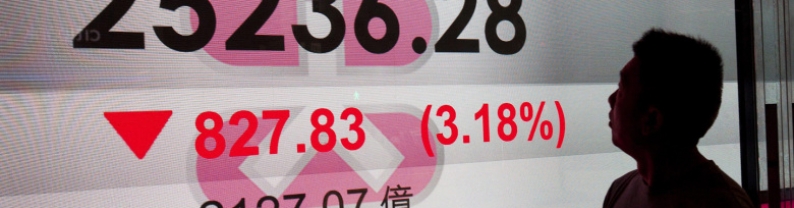

Hong Kong stocks were back in the red Friday as markets digested news of a softening U.S. job market and an unexpected decline in China's export figures. The Hang Seng Index decreased by around 244.07 points, or roughly 0.9%, to end at 26,241.83. The Hang Seng China Enterprises Index fell around 88.41 points, or 0.9%, to 9,267.56. China's exports in October slipped 1.1% year on year in US dollar terms to $305.4 billion, missing a consensus estimate of a 2.9% increase, according to a Bloomberg survey, the South China Morning Post reported. The contraction could signal a worsening outlook...

EUR/USD halts its five-day losing streak, trading around 1.1610 during the Asian hours on Wednesday. The pair appreciates despite the stable US Dollar (USD), driven by traders' caution ahead of the upcoming US Producer Price Index (PPI) later on Wednesday. The Fed Beige Book and Industrial Production will also be eyed. However, the US Dollar may regain its ground as the US inflation report for June reignited concerns about prolonged high Federal Reserve (Fed) interest rates. The US Consumer Price Index (CPI) rose 2.7% year-over-year in June, matching market expectations. Core CPI came in...

Silver price (XAG/USD) gains ground after registering losses in the previous two sessions, trading around $37.80 per troy ounce during the Asian hours on Wednesday. The safe-haven demand for Silver grows amid uncertainty from tariffs. US President Donald Trump sent notified 25 countries of new tariff rates set to take effect on August 1st, including major trading partners Canada, Mexico, and the European Union (EU). Moreover, Trump said late Tuesday that letters notifying smaller countries, including nations in Africa and the Caribbean, of their US tariff rates would go out soon, per...

The Japanese Yen (JPY) hit a fresh low since April against its American counterpart during the Asian session on Wednesday, with the USD/JPY bulls now awaiting a sustained strength beyond the 149.00 mark before placing fresh bets. Investors pared their bets for an immediate interest rate hike by the Bank of Japan (BoJ) amid concerns about the economic fallout from higher US tariffs. This, in turn, has been a key factor behind the JPY's relative underperformance since the beginning of this month. Adding to this, domestic political uncertainty ahead of the House of Councillors election on...

The Australian dollar strengthened to around $0.653 on Wednesday, snapping a three-day losing streak, as investors turned their attention to Thursday's labor market data, which could provide fresh insight into the near-term policy outlook. The Reserve Bank of Australia has recently adopted a cautious, data-driven stance, citing a more balanced inflation outlook and ongoing labor market resilience. And a robust jobs report could cast doubt on the 80% market-implied probability of a rate cut at next month's meeting. Markets are currently expecting a gain of 20,000 jobs in June and an...

The U.S. dollar rose alongside Treasury yields on Wednesday, which in turn kept pressure on the yen after the latest U.S. inflation report showed signs that President Donald Trump's tariffs were beginning to feed into prices. Rising prices on goods as varied as coffee, audio equipment and home furnishing pulled the inflation rate higher in June, with substantial increases in prices of the heavily imported items. That pushed the dollar and bond yields higher as investors pared back expectations of Federal Reserve interest rate cuts this year. The jump in the dollar was most apparent...