Chicago Federal Reserve President Austan Goolsbee on Thursday said the lack of official data on inflation during the government shutdown "accentuates" his caution about cutting interest rates further.

"I lean more to the, when it's foggy, let's just be a little careful and slow down" Goolsbee said in an interview with CNBC.

Fed policymakers are relying on private data and their own surveys and outreach to gauge where the economy is heading while official economic data from the Bureau of Labor Statistics and other U.S. agencies is on pause during what is now a record-long federal government shutdown.

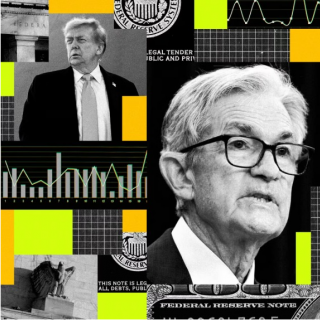

After the Fed cut the policy rate last week for the second month in a row, Fed Chair Jerome Powell said he feels the lack of government data could be a reason to slow down, as one does when "driving in the fog."

Goolsbee said the Fed still has access to a range of private data on the state of the job market, including his own Fed bank's new biweekly estimate of the jobless rate, which on Thursday showed the unemployment rate likely edged up in October to 4.4%, the highest in four years.

That estimate, and most of the other available labor market indicators, suggests there's "a lot of stability in the job market," Goolsbee said, adding, "if it starts to deteriorate on the job market side we're going to see that pretty much right away."

There are far fewer sources of data on inflation outside of the official data, he said, and noted that just before the government stopped publishing economic data the statistics had shown an uptick in inflation.

"If inflation starts to go wrong, we're not really going to get observations that show that," Goolsbee said. "That accentuates my caution of front-loading rate cuts and just assuming that the inflation that we've seen the last three months is going to go away."

Source: Investing.com

Stephen Miran, a Federal Reserve governor whose term ends at the end of January, said Thursday that he is looking for 150 basis points of interest-rate cuts this year to boost the U.S. labor market. ...

Federal Reserve Vice Chair for Supervision Michelle Bowman outlined significant changes to bank supervision and regulation during a speech at the California Bankers Association Bank Presidents Seminar...

Further changes to the Federal Reserve's short-term interest rate will need to be "finely tuned" to incoming data given the risks to both the U.S. central bank's employment and inflation goals, Richmo...

Richmond Federal Reserve Bank President Tom Barkin said the monetary policy outlook remains in a fragile balance given the conflicting pressures of rising unemployment and persistently high inflation....

The US Federal Reserve agreed to cut interest rates at its December meeting only after a highly nuanced debate about the current risks facing the US economy, according to minutes from the two-day meet...

Oil prices stabilized on Thursday (February 12th), as the market reassigned a risk premium to US-Iran tensions despite US inventory data showing swelling domestic supplies. This movement confirms one thing: geopolitical headlines are still more...

Gold prices weakened slightly on Thursday (February 12th), as more solid US employment data reduced market confidence in an imminent Federal Reserve interest rate cut. The strong employment data prompted market participants to shift expectations of...

The Hang Seng Index reversed its downward trend in Hong Kong on Thursday (February 12th), weakening by around 0.9% to around 27,000 after a strong session earlier. This decline halted the momentum of the short term rally, as investors began to...