Investors cheered Federal Reserve Chair Jerome Powell's Jackson Hole address, which gave a green light to buy risky assets on the hope the central bank is ready to cut rates, but took his dovish message with a note of caution as they see a risk of stagflation ahead and worry markets are over-optimistic.

In his final address as Fed chair at the Jackson Hole, Wyoming, economic symposium, Powell hinted at a September interest rate cut but stopped short of committing, striking a careful balance between mounting job-market risks and lingering inflation worries.

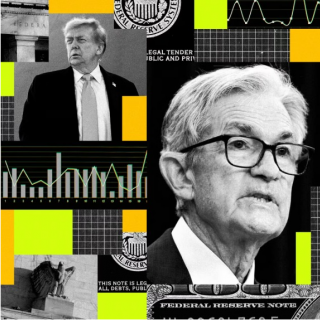

The speech on Friday came amid mounting pressure from the White House to ease monetary policy, which has raised market concerns that political influence will lead the U.S. central bank to become too aggressive in cutting rates in the future.

"Powell definitely locked in that September rate cut and the certainty of that is rippling in a positive way across global markets," said Matthew Miskin, co-chief investment strategist at Manulife John Hancock Investments. "This still leaves, what happens after September? And I think that's where the markets are getting ahead of themselves," he said.

The Jackson Hole address followed a weak July jobs report and significant downward revisions to earlier job figures that fueled bets the U.S. central bank will cut interest rates later this year from the current 4.25%-4.5% range.

Those expectations, however, lost steam in recent weeks as a surge in wholesale prices in July fueled concerns that stubbornly high inflation would limit the Fed's ability to come to the market's rescue with hefty rate cuts.

"People have been increasingly worried that we're kind of heading into a stagflationary story," said Drew Matus, chief market strategist at Metlife (NYSE:MET) Investment Management, referring to a worrying mix of sluggish growth and relentless inflation.

Matus added that investors were expecting inflation would "stick around for a little bit," but said the real question remains over how much the economy can grow.

"I think we're going to get some growth, but it's not going to feel great," said Matus.

Investors also noted that more data on inflation and the labor market are due ahead of the Fed's next meeting and could factor into rate decisions, potentially stalling any rally.

"Looking over the next couple months, rate cuts alone won't be enough to sustain strength in stocks," said Tom Graff, chief investment officer at Facet. "If in fact the economy is stalling and the labor market continues to deteriorate, there are risks to this equity market rally."

RATE CUT BETS

Others in the market said optimism was warranted.

"If the Fed is going to move here and cut rates gradually and take their foot off the brake a little bit for the economy, I think it makes perfect sense that we're seeing a rebound," said Paul Eitelman, global chief investment strategist at Russell Investments.

Rates futures traders assigned a 70% probability to a quarter-point interest rate cut in September ahead of Powell's speech. Late on Friday that stood at 80%, LSEG data showed.

Source: Investing.com

Stephen Miran, a Federal Reserve governor whose term ends at the end of January, said Thursday that he is looking for 150 basis points of interest-rate cuts this year to boost the U.S. labor market. ...

Federal Reserve Vice Chair for Supervision Michelle Bowman outlined significant changes to bank supervision and regulation during a speech at the California Bankers Association Bank Presidents Seminar...

Further changes to the Federal Reserve's short-term interest rate will need to be "finely tuned" to incoming data given the risks to both the U.S. central bank's employment and inflation goals, Richmo...

Richmond Federal Reserve Bank President Tom Barkin said the monetary policy outlook remains in a fragile balance given the conflicting pressures of rising unemployment and persistently high inflation....

The US Federal Reserve agreed to cut interest rates at its December meeting only after a highly nuanced debate about the current risks facing the US economy, according to minutes from the two-day meet...

Oil prices stabilized on Thursday (February 12th), as the market reassigned a risk premium to US-Iran tensions despite US inventory data showing swelling domestic supplies. This movement confirms one thing: geopolitical headlines are still more...

Gold prices weakened slightly on Thursday (February 12th), as more solid US employment data reduced market confidence in an imminent Federal Reserve interest rate cut. The strong employment data prompted market participants to shift expectations of...

The Hang Seng Index reversed its downward trend in Hong Kong on Thursday (February 12th), weakening by around 0.9% to around 27,000 after a strong session earlier. This decline halted the momentum of the short term rally, as investors began to...