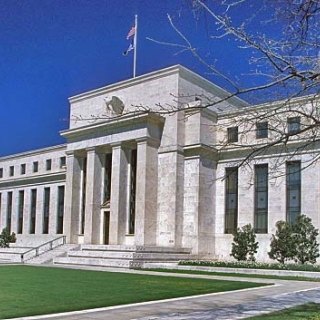

The minutes of the Federal Reserve's (Fed) discount rate meetings from April 7, 28, and May 8 revealed that policymakers are increasingly uneasy about the coming economic impacts, mostly from U.S. trade policy. While overall economic conditions are stable, tariff uncertainty continues to weigh on business operators, who are preparing contingency plans and slowing their investment and spending rates.

Key highlights

Overall, central bank directors noted considerable uncertainty about the outlook.

While most directors described current economic conditions as generally stable, they also expressed concerns about the potential impact of evolving trade and other policies on economic activity, prices, and employment.

Given the heightened uncertainty, many directors noted that consumers and businesses are becoming more cautious about their spending and future plans.

Several directors commented on expected price pressures related to tariffs, including higher prices for consumers.

Labor market conditions remain healthy, with several directors noting low employee turnover and limited layoffs.

Several directors said businesses in their districts had indicated future staff reductions may be necessary to absorb costs associated with tariffs and reduced government funding in certain sectors. (alg)

Source: FXstreet

Stephen Miran, a Federal Reserve governor whose term ends at the end of January, said Thursday that he is looking for 150 basis points of interest-rate cuts this year to boost the U.S. labor market. ...

Federal Reserve Vice Chair for Supervision Michelle Bowman outlined significant changes to bank supervision and regulation during a speech at the California Bankers Association Bank Presidents Seminar...

Further changes to the Federal Reserve's short-term interest rate will need to be "finely tuned" to incoming data given the risks to both the U.S. central bank's employment and inflation goals, Richmo...

Richmond Federal Reserve Bank President Tom Barkin said the monetary policy outlook remains in a fragile balance given the conflicting pressures of rising unemployment and persistently high inflation....

The US Federal Reserve agreed to cut interest rates at its December meeting only after a highly nuanced debate about the current risks facing the US economy, according to minutes from the two-day meet...

Oil prices stabilized on Thursday (February 12th), as the market reassigned a risk premium to US-Iran tensions despite US inventory data showing swelling domestic supplies. This movement confirms one thing: geopolitical headlines are still more...

Gold prices weakened slightly on Thursday (February 12th), as more solid US employment data reduced market confidence in an imminent Federal Reserve interest rate cut. The strong employment data prompted market participants to shift expectations of...

The Hang Seng Index reversed its downward trend in Hong Kong on Thursday (February 12th), weakening by around 0.9% to around 27,000 after a strong session earlier. This decline halted the momentum of the short term rally, as investors began to...