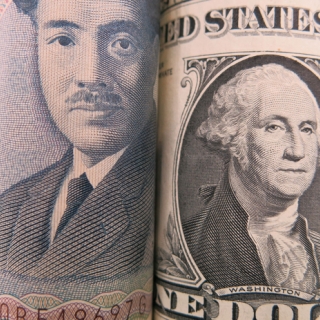

The US dollar (USD) started the week on a positive note, continuing its modest recovery since Thursday, as easing global trade tensions boosted investor sentiment. Interestingly, the greenback, which typically underperforms in a risk-on environment, found support despite improved risk appetite, bolstered by expectations that the Federal Reserve (Fed) will keep interest rates unchanged at its monetary policy decision on Wednesday. Notably, a series of trade agreements concluded last week also provided support for the greenback, with the looming August 1 tariff deadline keeping markets on edge.

The US Dollar Index (DXY), which tracks the greenback against a basket of six major currencies, continued its gains for the third consecutive day, rising nearly 0.50% during American trading hours as markets cheered the breakthrough trade agreement between the United States (US) and the European Union (EU). At the time of writing, the index was hovering around 98.15, marking its highest level in nearly a week.

The new US-EU trade framework agreement was finalized after US President Donald Trump and European Commission President Ursula von der Leyen met briefly at Trump's Turnberry golf course in Scotland on Sunday. Under the agreement, the US will impose 15% tariffs on most EU imports, such as cars, semiconductors, and pharmaceuticals, significantly lower than the previously threatened 30%. According to Reuters, the base tariff will be complemented by "zero-for-zero" tariff exemptions covering strategic sectors including aircraft and parts, certain chemicals, semiconductor manufacturing equipment, generic drugs, agricultural goods, and key raw materials.

In return, the EU has committed to purchasing $250 billion worth of US liquefied natural gas (LNG) annually, totaling about $750 billion over three years. The deal also outlines a $600 billion EU investment package in the US, focused on strategic sectors such as clean energy, defense equipment, and manufacturing. Although the agreement maintains existing 50% tariffs on steel and aluminum, officials have hinted that a quota-based system could replace them in future negotiations. (alg)

Source: FXstreet

The USD/CHF pair weakened for the third consecutive day and traded around 0.7960 in early European trading on Tuesday. The Swiss franc strengthened on increased demand for safe haven assets, following...

The US Dollar Index (DXY) trended sluggishly around 99.06 on Monday (January 19th), as liquidity thinned as US markets were closed for Martin Luther King Jr. Day. Despite limited movement, global sent...

The US dollar is expected to rise for a third straight day on Thursday (January 8), but trading remains cautious as investors position themselves ahead of Friday's Nonfarm Payrolls (NFP) report. Recen...

The dollar index edged up to 98.5 on Tuesday, its strongest level in more than two weeks, as investors focused on a slate of key economic data for the US. Recent indicators have pointed to some soften...

The US dollar opened 2026 weakly on Friday. Throughout last year, the dollar was pressured by many major currencies due to narrowing interest rate differentials between the US and other countries. Con...

Oil prices stabilized on Thursday (February 12th), as the market reassigned a risk premium to US-Iran tensions despite US inventory data showing swelling domestic supplies. This movement confirms one thing: geopolitical headlines are still more...

Gold prices weakened slightly on Thursday (February 12th), as more solid US employment data reduced market confidence in an imminent Federal Reserve interest rate cut. The strong employment data prompted market participants to shift expectations of...

The Hang Seng Index reversed its downward trend in Hong Kong on Thursday (February 12th), weakening by around 0.9% to around 27,000 after a strong session earlier. This decline halted the momentum of the short term rally, as investors began to...