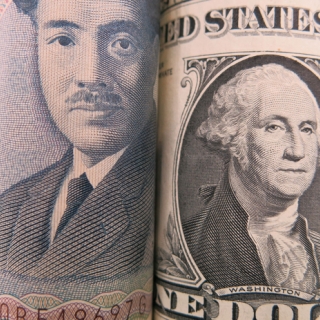

The US Dollar Index (DXY), a measure of the value of the US Dollar (USD) against a basket of six major currencies, attracted some buyers around 103.50 during the early European session on Wednesday (3/19). Traders are preparing for the Federal Reserve's (Fed) interest rate decision later on Wednesday, with no change in interest rates expected.

Fed officials' fresh economic projections will be closely watched as they could provide some clues on how policymakers view the possible impact of US President Donald Trump's administration's policies.

Technically, the bearish outlook for the DXY remains in place, as the index is holding below the key 100-day Exponential Moving Average (EMA) on the daily timeframe. The path of least resistance is to the downside as the 14-day Relative Strength Index (RSI), which is below the midline near 31.15, favors sellers in the near term. In a bearish event, the March 18 low of 103.20 acts as an initial support level for the USD index. The key level to watch is 102.00, which represents the psychological level and the lower boundary of the Bollinger Band. A sustained decline could lead to a drop to 100.53, the August 28, 2024 low.

On the upside, the immediate resistance level for the DXY comes in at 104.10, the March 14 high. Further north, the next hurdle is seen at 105.45, the November 6, 2024 high. Any follow-through buying above this level could lead to a rally to 106.10, the 100-day EMA.(Newsmaker23)

Source: FXstreet

The USD/CHF pair weakened for the third consecutive day and traded around 0.7960 in early European trading on Tuesday. The Swiss franc strengthened on increased demand for safe haven assets, following...

The US Dollar Index (DXY) trended sluggishly around 99.06 on Monday (January 19th), as liquidity thinned as US markets were closed for Martin Luther King Jr. Day. Despite limited movement, global sent...

The US dollar is expected to rise for a third straight day on Thursday (January 8), but trading remains cautious as investors position themselves ahead of Friday's Nonfarm Payrolls (NFP) report. Recen...

The dollar index edged up to 98.5 on Tuesday, its strongest level in more than two weeks, as investors focused on a slate of key economic data for the US. Recent indicators have pointed to some soften...

The US dollar opened 2026 weakly on Friday. Throughout last year, the dollar was pressured by many major currencies due to narrowing interest rate differentials between the US and other countries. Con...

Oil prices stabilized on Thursday (February 12th), as the market reassigned a risk premium to US-Iran tensions despite US inventory data showing swelling domestic supplies. This movement confirms one thing: geopolitical headlines are still more...

Gold prices weakened slightly on Thursday (February 12th), as more solid US employment data reduced market confidence in an imminent Federal Reserve interest rate cut. The strong employment data prompted market participants to shift expectations of...

The Hang Seng Index reversed its downward trend in Hong Kong on Thursday (February 12th), weakening by around 0.9% to around 27,000 after a strong session earlier. This decline halted the momentum of the short term rally, as investors began to...