Oil prices retreated on Thursday as U.S. President Donald Trump ramped up a trade war with China, even as he announced a 90-day pause on tariffs aimed at other countries.

Brent futures fell 77 cents, or 1.18%, to $64.71 a barrel by 0320 GMT, while U.S. West Texas Intermediate crude futures fell 65 cents, or 1.04%, to $61.70.

Following the tariff pause for most countries, the benchmark crude contracts had settled 4% higher on Wednesday after dropping as much as 7% during the session.

Trump, however, raised the tariff rate for China to 125% effective immediately, from the previously announced 104% tariff that had kicked off earlier on Wednesday.

The higher U.S. tariffs on China leave plenty of uncertainty in the markets, ING commodities strategists said in a research note on Thursday.

"This uncertainty is still likely to drag on global growth, which is clearly a concern for oil demand," they said.

"The ICE Brent forward curve is signalling a better-supplied oil market," the strategists said, with ICE Brent shifting into contango from the January 2026 contract onwards.

China also announced an additional import levy on U.S. goods, imposing an 84% tariff from Thursday.

"We may expect oil prices to resume its broader downward trend once the optimism around the recent tariff reprieve fades," said Yeap Jun Rong, market strategist at online trading platform IG.

"Demand-side headwinds persist, with China's growth outlook at risk from the ongoing tit-for-tat," Yeap said.

Investors were eyeing mixed supply drivers as well.

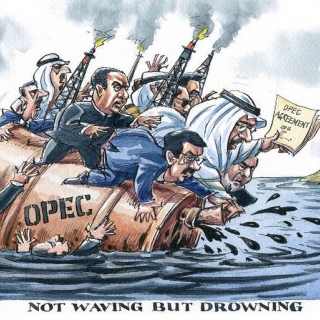

"Prices also found some support after the Keystone Pipeline declared force majeure on scheduled oil shipments," said ANZ Research analysts on Thursday, noting though there were downside risks on signs of surging supply from OPEC members.

The Keystone oil pipeline from Canada to the United States remained shut on Wednesday following an oil spill near Fort Ransom, North Dakota, while plans to return it to service were being evaluated, its operator South Bow said.

Elsewhere, the Caspian Pipeline Consortium resumed loading oil at one of two previously shut Black Sea moorings, it said on Wednesday, after a court lifted restrictions put on the Western-backed group's facility by a Russian regulator.

In the United States, crude inventories rose by 2.6 million barrels in the week to April 4, the Energy Information Administration said, nearly double the expectations in a Reuters poll for a 1.4-million-barrel rise

Source: Investing.com

Oil prices stabilized on Thursday (February 12th), as the market reassigned a risk premium to US-Iran tensions despite US inventory data showing swelling domestic supplies. This movement confirms one ...

Oil prices rose on Wednesday (February 11th), supported by a combination of geopolitical risk premiums from US-Iran tensions and more solid Asian demand signals particularly from India which helped ea...

Oil remained in the green zone on Tuesday (February 10th), as the market refused to abandon the Middle East risk premium. As of 13:07 GMT (20:07 WIB), Brent rose +0.4% to $69.32/barrel, while WTI rose...

Oil prices fell about 1% on Monday as concerns about conflict in the Middle East eased slightly. The market calmed after the US and Iran agreed to resume talks on Tehran's nuclear program, reducing fe...

Oil prices moved slightly higher in a volatile session on Friday, as investors assessed the direction of nuclear negotiations between the United States and Iran. Price movements appeared sensitive to ...

Oil prices stabilized on Thursday (February 12th), as the market reassigned a risk premium to US-Iran tensions despite US inventory data showing swelling domestic supplies. This movement confirms one thing: geopolitical headlines are still more...

Gold prices weakened slightly on Thursday (February 12th), as more solid US employment data reduced market confidence in an imminent Federal Reserve interest rate cut. The strong employment data prompted market participants to shift expectations of...

The Hang Seng Index reversed its downward trend in Hong Kong on Thursday (February 12th), weakening by around 0.9% to around 27,000 after a strong session earlier. This decline halted the momentum of the short term rally, as investors began to...