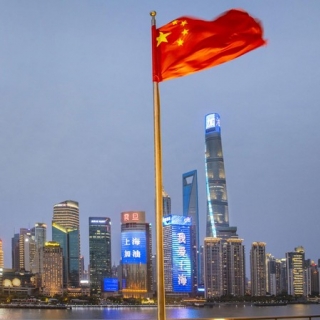

Asia-Pacific markets traded mixed Monday as China's central bank held rates at a time when the yuan has come under pressure due to Beijing-Washington trade tensions.

Mainland China's CSI 300 rose 0.18% after the People's Bank of China kept its key loan prime rates unchanged at 3.10% for 1-year loan maturities and 3.60% for 5-year loan maturities, in line with the expectations of economists polled by Reuters.

Japan's benchmark Nikkei 225 fell 1.24%, while the broader Topix index declined 1.18%.

In South Korea, the Kospi index was flat while the small-cap Kosdaq moved down 0.27% in choppy trade.

Australian and Hong Kong markets were closed for the Easter holiday.

Investors are focused on U.S. President Donald Trump's trade policies, as they continue to roil global markets.

Last week, Trump called for the U.S. Federal Reserve to cut interest rates while adding that the termination of Fed Chair Jerome Powell "cannot come fast enough." Trump's comments came after Powell cautioned that ongoing trade tensions could challenge the central bank's goals of controlling inflation and spurring growth.

U.S. futures fell after all three major benchmarks logged their third weekly decline, in the last four trading weeks.

The broad-based S&P 500 ended Thursday's session higher, but still finished the holiday-shortened week 1.5% lower.

Meanwhile, the Dow Jones Industrial Average and Nasdaq Composite posted their third consecutive losing session, each declining over 2% in the four-day trading week.

source: CNBC

Tested EN...

Asian stock markets weakened for the second consecutive day, indicating that the initial rally that had been "speedy" at the start of the year is starting to lose steam. At the same time, US governmen...

US stocks were mixed on Wednesday as investors weighed uneven economic data against expectations for eventual Federal Reserve easing, with the S&P 500 easing 0.2% and the Dow Jones sliding 0.8% fr...

European stocks were in mixed territory on Wednesday morning, as regional market jitters grow over U.S. President Donald Trump's threat to annex Greenland. The pan-European Stoxx 600 was little chang...

Asian stock markets weakened slightly on Wednesday after posting their best start to the year in history. The decline was driven by a decline in Japanese stocks amid escalating tensions with China. Th...

Oil prices stabilized on Thursday (February 12th), as the market reassigned a risk premium to US-Iran tensions despite US inventory data showing swelling domestic supplies. This movement confirms one thing: geopolitical headlines are still more...

Gold prices weakened slightly on Thursday (February 12th), as more solid US employment data reduced market confidence in an imminent Federal Reserve interest rate cut. The strong employment data prompted market participants to shift expectations of...

The Hang Seng Index reversed its downward trend in Hong Kong on Thursday (February 12th), weakening by around 0.9% to around 27,000 after a strong session earlier. This decline halted the momentum of the short term rally, as investors began to...