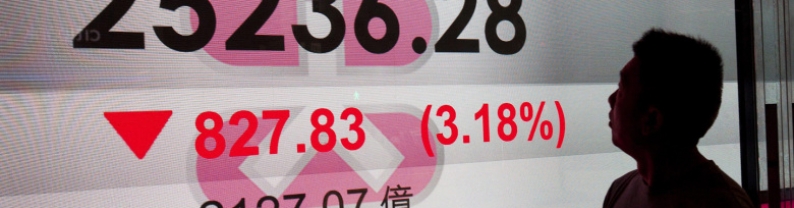

Hong Kong stocks were back in the red Friday as markets digested news of a softening U.S. job market and an unexpected decline in China's export figures. The Hang Seng Index decreased by around 244.07 points, or roughly 0.9%, to end at 26,241.83. The Hang Seng China Enterprises Index fell around 88.41 points, or 0.9%, to 9,267.56. China's exports in October slipped 1.1% year on year in US dollar terms to $305.4 billion, missing a consensus estimate of a 2.9% increase, according to a Bloomberg survey, the South China Morning Post reported. The contraction could signal a worsening outlook...

The EUR/USD pair attracts some follow-through selling for the second straight day on Wednesday and drops to a one-week low during the Asian session. Spot prices, however, rebound a few pips from the 1.1300 neighborhood and currently trade around the 1.1380 region, still down over 0.35% for the day. The US Dollar (USD) builds on the overnight bounce from the vicinity of a three-year low touched on Monday and turns out to be a key factor exerting downward pressure on the EUR/USD pair. That said, the weakening confidence in the US economy, along with the prospects for more aggressive policy...

AUD/USD attracts some dip-buyers to hold near 0.6400 in the Asian session on Wednesday. Hopes for a possible de-escalation in the US-China trade war boost investors' appetite for riskier assets and support the Aussie. Further, the pause in the US Dollar rebound also aids the pair's upside. the Australian Dollar (AUD) lost some upside traction, sending AUD/USD back toward the 0.6370 region despite the earlier advance to the area of yearly peaks around 0.6440. The late retracement in the pair came on the back of a pick-up in the buying interest around the US Dollar (USD) amid unabated jitters...

Silver price (XAG/USD) retraces its recent losses from the previous session, trading around $32.70 per troy ounce during the Asian hours on Wednesday. However, prices of grey metal faced headwinds as investor optimism grew over the Federal Reserve's (Fed) independence. US President Donald Trump helped calm markets by clarifying he has no intention of removing Fed Chair Jerome Powell, stating, "The press runs away with things. No, I have no intention of firing him. I would like to see him be a little more active in terms of his idea to lower interest rates." Market sentiment was further...

Oil prices extended gains in Asian trading on Wednesday as the U.S. imposed fresh sanctions on Iran amid ongoing nuclear talks, while investors assessed a weekly report showing a large decline in U.S. crude stockpiles. Market sentiment was further bolstered by U.S. President Donald Trump stepping back from earlier threats to dismiss Federal Reserve Chair Jerome Powell and expressing confidence in the country's trade relations As of 21:07 ET (01:07 GMT), Brent Oil Futures expiring in June rose 1% to $68.12 per barrel, while West Texas Intermediate (WTI) crude futures also advanced 1% to...

Gold price (XAU/USD) attracted dip-buyers in Asia on Wednesday, stalling its retreat from the $3,500 peak hit the day before. The attempted US Dollar (USD) recovery from a multi-year low faltered amid the weakening confidence in the US economy on the back of US President Donald Trump's back-and-forth tariff announcements. Apart from this, the prospects for more aggressive policy easing by the Federal Reserve (Fed) prompt some intraday USD selling and turn out to be a key factor that helps revive demand for the non-yielding yellow metal. Meanwhile, Trump administration officials hinted at a...