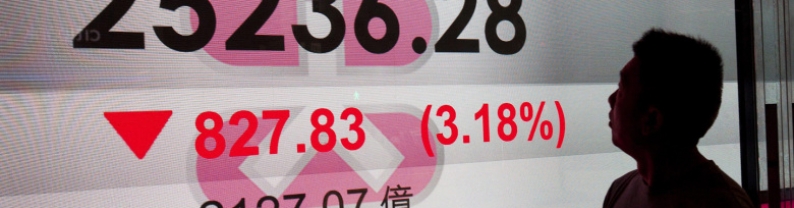

Hong Kong stocks were back in the red Friday as markets digested news of a softening U.S. job market and an unexpected decline in China's export figures. The Hang Seng Index decreased by around 244.07 points, or roughly 0.9%, to end at 26,241.83. The Hang Seng China Enterprises Index fell around 88.41 points, or 0.9%, to 9,267.56. China's exports in October slipped 1.1% year on year in US dollar terms to $305.4 billion, missing a consensus estimate of a 2.9% increase, according to a Bloomberg survey, the South China Morning Post reported. The contraction could signal a worsening outlook...

The Pound Sterling (GBP) recovers some of its initial losses against the US Dollar (USD) in Wednesday's European session, still trading lower in the day around 1.3300. The GBP/USD pair pares some intraday losses as the US Dollar (USD) retraces after a sharp upside move on Wednesday. The US Dollar Index (DXY), which tracks the Greenback's value against six major currencies, corrects to near 99.20 from the earlier high of 99.88. Investors brace for more recovery in the US Dollar on optimism over de-escalation in the United States (US)-China trade war and diminishing fears of President Donald...

Gold prices fell more than 2% on Wednesday as U.S. President Donald Trump backed down from threats to dismiss Federal Reserve Chair Jerome Powell and expressed optimism for a trade deal with top metals consumer China, denting bullion's safe-haven appeal. Spot gold declined 2.2% to $3,308.81 an ounce as of 0704 GMT. U.S. gold futures shed 2.9% to $3,320.30. Hopes for a U.S.-China trade deal and Trump's softened stance toward Powell "caused the sell-off in gold price to hit a kind of a very extreme oversold level in the short term perspective here," said Kelvin Wong, senior market analyst,...

The dollar index rose above 99 on Wednesday, building on a 0.7% gain from the previous session, as concerns over the Federal Reserve's independence eased and hopes for a de-escalation in the trade war grew. President Trump stated he has no intention of dismissing Fed Chair Jerome Powell, alleviating fears of political interference in US monetary policy. He also signaled a softer stance toward China, saying he plans to be "very nice" in any trade negotiations. Meanwhile, Treasury Secretary Scott Bessent acknowledged that the tariff standoff with China is unsustainable and stressed the need...

Gold price (XAU/USD) attracts some sellers for the second straight day on Wednesday and extends the previous day's rejection slide from the $3,500 psychological mark or a fresh record high. US President Donald Trump's administration officials hinted at a potential de-escalation of the ongoing tariff dispute with China and fueled optimism about a trade deal. Adding to this Trump stepped back from his threats to dismiss Federal Reserve (Fed) Chair Jerome Powell. Furthermore, Russian President Vladimir Putin indicated he is open to the prospect of direct talks with his Ukrainian counterpart...

The GBP/USD pair remains weak near 1.3280 during the early Asian session on Wednesday. Comments by US Treasury Secretary Scott Bessent hint at a thaw in US-China trade tensions, fueling optimism in markets and strengthening the US Dollar (USD) against the Pound Sterling (GBP). Scott Bessent said on Tuesday that he expects a de-escalation in US President Donald Trump's trade war with China in the very near future. He further stated that the tariff standoff with China cannot be sustained by both sides and that the world's two largest economies will have to find ways to...