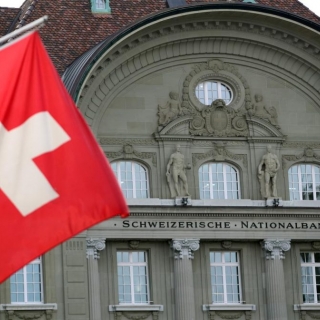

The Swiss National Bank cut its interest rate by 50 basis points on Thursday, the biggest reduction in almost 10 years as it sought to stay ahead of expected cuts by other central banks and cap the rise of the Swiss franc.

The SNB reduced its policy rate from 1.0% to 0.5%, the lowest since November 2022.

While markets had predicted the move, more than 85% of economists polled by Reuters had expected a smaller cut of 25 basis points.

It is the steepest drop in borrowing costs since the SNB's emergency rate cut in January 2015 when it suddenly quit its minimum exchange rate with the euro.

"Underlying inflationary pressure has decreased again this quarter. The SNB's easing of monetary policy today takes this development into account," the SNB said.

"The SNB will continue to monitor the situation closely, and will adjust its monetary policy if necessary to ensure inflation remains within the range consistent with price stability over the medium term."

Thursday's decision was the first under new SNB Chairman Martin Schlegel, and saw an acceleration from the policy of predecessor Thomas Jordan, who oversaw three reductions of 25 basis points this year.

It was made possible by weak Swiss inflation, which was 0.7% in November, and has been within the SNB's 0-2% target range, which it calls price stability, since May 2023.

The European Central Bank is also expected to cut rates later on Thursday and the U.S. Federal Reserve on Dec. 18.

The Bank of Canada cut its main policy rate by 50 basis points on Wednesday.

Narrowing interest rate differentials between Switzerland and other countries increase the attractiveness of the safe-haven franc, boosting the currency.

The franc's appreciation is an additional headache for Swiss exporters, making their exports more expensive when they are already facing subdued demand in Europe and China.

"Low inflation and risks to the European economy and thus to the Swiss economy may have been major drivers for this rate cut," said UBS economist Alessandro Bee.

"Furthermore, by cutting by 50 basis points the SNB is likely to widen the interest rates differential and thereby pre-emptively counter excessive Swiss franc strength."

The SNB now expects growth of between 1% and 1.5% for 2025. It had previously predicted 1.5% for next year.

The central bank expects inflation to remain within its target range. For 2024, the SNB sees Swiss prices rising by 1.1%, by 0.3% in 2025 and 0.8% in 2026.

This compared with its previous forecast for inflation at 1.2% this year, 0.6% in 2025 and 0.7% in 2026.

Source : Reuters

Stephen Miran, a Federal Reserve governor whose term ends at the end of January, said Thursday that he is looking for 150 basis points of interest-rate cuts this year to boost the U.S. labor market. ...

Federal Reserve Vice Chair for Supervision Michelle Bowman outlined significant changes to bank supervision and regulation during a speech at the California Bankers Association Bank Presidents Seminar...

Further changes to the Federal Reserve's short-term interest rate will need to be "finely tuned" to incoming data given the risks to both the U.S. central bank's employment and inflation goals, Richmo...

Richmond Federal Reserve Bank President Tom Barkin said the monetary policy outlook remains in a fragile balance given the conflicting pressures of rising unemployment and persistently high inflation....

The US Federal Reserve agreed to cut interest rates at its December meeting only after a highly nuanced debate about the current risks facing the US economy, according to minutes from the two-day meet...

Oil prices stabilized on Thursday (February 12th), as the market reassigned a risk premium to US-Iran tensions despite US inventory data showing swelling domestic supplies. This movement confirms one thing: geopolitical headlines are still more...

Gold prices weakened slightly on Thursday (February 12th), as more solid US employment data reduced market confidence in an imminent Federal Reserve interest rate cut. The strong employment data prompted market participants to shift expectations of...

The Hang Seng Index reversed its downward trend in Hong Kong on Thursday (February 12th), weakening by around 0.9% to around 27,000 after a strong session earlier. This decline halted the momentum of the short term rally, as investors began to...