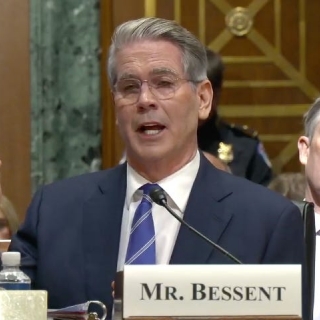

US Treasury Secretary Scott Bessent said interest rates are "too constrictive" and should likely be 150-175 basis points lower.

Bessent, speaking in an interview on Bloomberg Television, said the Federal Reserve could be heading into a series of rate cuts in the coming months — starting with a half-point reduction in September.

"There's a very good chance of a 50 basis point rate cut," Bessent said Wednesday. "We could go into a series of rate cuts here, starting with a 50 basis point rate cut in September."

Bessent added, that by any model, rates "should probably be 150, 175 basis points lower."

The US central bank has held the benchmark interest rate steady this year in a target range of 4.25%-4.5%.

Source: Bloomberg

The upcoming Supreme Court ruling on the legality of President Donald Trump's massive tariffs, which rocked markets in April, is one of the next major tests for US stocks and bonds. Equity markets ha...

The US seized two Venezuela-linked oil tankers in the Atlantic Ocean on Wednesday, one of which was sailing under a Russian flag, as part of President Donald Trump's aggressive efforts to regulate oil...

France is working with partners on a plan on how to respond should the United States act on its threat to take over Greenland, a minister said on Wednesday, as Europe sought to address U.S. President ...

The world community must make clear that U.S. intervention in Venezuela is a violation of international law that makes the world less safe, the Office of the United Nations High Commissioner for Human...

US President Donald Trump threatened on Friday to come to the aid of protesters in Iran if security forces open fire on them, days after unrest that has killed several people and posed the biggest int...

Oil prices stabilized on Thursday (February 12th), as the market reassigned a risk premium to US-Iran tensions despite US inventory data showing swelling domestic supplies. This movement confirms one thing: geopolitical headlines are still more...

Gold prices weakened slightly on Thursday (February 12th), as more solid US employment data reduced market confidence in an imminent Federal Reserve interest rate cut. The strong employment data prompted market participants to shift expectations of...

The Hang Seng Index reversed its downward trend in Hong Kong on Thursday (February 12th), weakening by around 0.9% to around 27,000 after a strong session earlier. This decline halted the momentum of the short term rally, as investors began to...