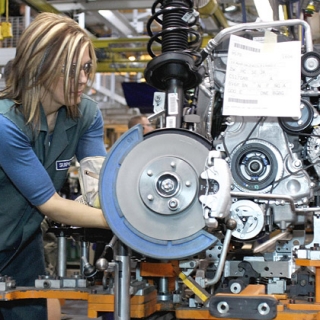

US manufacturing activity in August surged to 53.3 (above 50 = expansion), the highest since May 2022. Surging demand boosted production and a buildup of backlogs, lifting the Composite PMI (a combination of manufacturing and services) to its highest level this year. However, despite the strengthening performance, companies admitted they were struggling to meet accelerating sales.

Survey details show factory output and backlogs rose to their highest levels since mid-2022, while new orders reached their highest levels since February 2024. Responding to strong demand, manufacturers are again adding workers, at the fastest hiring rate since March 2022.

On the price side, tariffs/higher imports are intensifying cost pressures and pushing composite selling prices to a three-year high. This indicates that consumers are beginning to bear the brunt of price increases, particularly in the services sector, which recorded the highest billed prices in three years.

The services sector itself remains healthy, despite a slight decline in activity indicators; Sales actually grew the fastest this year, and backlogs remained the strongest since May 2022. Amid concerns over supply and trade policy, finished goods inventories surged to their highest level since 2007, reflecting efforts to anticipate future supply risks.

Key Points:

Manufacturing PMI 53.3 (highest since May 2022) → solid expansion.

Output, backlogs, and new orders rose; hiring accelerated the fastest since March 2022.

Selling prices hit a 3-year high due to tariff/cost pressures.

Sumber: Newsmaker.id

Renewed tensions between the United States and Russia have resurfaced following an incident involving an oil tanker, sparking market concerns about potential disruptions to global energy supplies. Was...

According to a report from the US Department of Labor (DOL) released on Thursday, the number of Americans filing new applications for unemployment insurance rose to 208,000 for the week ending January...

Geopolitical issues have heated up again after statements and political signals from the United States sparked speculation about a possible US takeover of Greenland. Although no concrete action has be...

Private employment rose less than economists expected in December, according to the ADP report. Private employment rose 41,000 (Estimate +50,000) in December, compared with a revised -29,000 in Novem...

Greenland is not only a strategic location, but also a world-class mineral repository. The island holds vast reserves of rare earth elements (REEs), essential for modern technology. These minerals are...

Oil prices stabilized on Thursday (February 12th), as the market reassigned a risk premium to US-Iran tensions despite US inventory data showing swelling domestic supplies. This movement confirms one thing: geopolitical headlines are still more...

Gold prices weakened slightly on Thursday (February 12th), as more solid US employment data reduced market confidence in an imminent Federal Reserve interest rate cut. The strong employment data prompted market participants to shift expectations of...

The Hang Seng Index reversed its downward trend in Hong Kong on Thursday (February 12th), weakening by around 0.9% to around 27,000 after a strong session earlier. This decline halted the momentum of the short term rally, as investors began to...