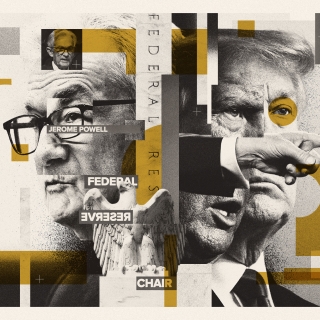

President Donald trump ramped up his attacks on Federal Reserve Chair Jerome Powell on Thursday, calling him a "numbskull" and demanding steep rate cuts to ease the $600 billion annual interest bill on U.S. debt. Now, with inflation cooling faster than expected, rate cuts could be on the Fed's monetary policy table as soon as September, according to Citi economists.

"We continue to pencil in 125bp of consecutive rate cuts from the Fed starting in September," Citi economists wrote, pointing to a rapid slowdown in core inflation as the key catalyst for policy easing.

Trump's latest broadside came after a duo of inflation reports this week showing softer-than-expected consumer and producer inflation data. The president said that "lowering rates by 2 percentage points would save the U.S. $600 billion per year, but we can't get this guy [Powell] to do it." He added, "We're going to spend $600 billion a year, $600 billion because of one numbskull that sits here [and says] ‘I don't see enough reason to cut the rates now.'" Trump also signaled he'd support higher rates if inflation were rising, but insisted, "it's down, and I may have to force something."

Citi economists' add to credence to the growing calls for sooner rate cuts, pointing to May's core CPI rising just 0.13% month-on-month—softer than both Citi's forecast and consensus.

"Softer underlying inflation dynamics should make Fed officials more comfortable with the idea that higher prices from tariffs will not lead to persistent inflationary pressures," the economists said, especially as the labor market continues to loosen.

While some upward pressure from tariffs are expected later this summer, Citi sees limited pass-through to consumer prices due to soft demand. "There was very little evidence that tariffs boosted consumer prices in May," they added, with services prices also remaining subdued and shelter inflation continuing to slow.

The economists' inflation forecasts show core PCE tracking at just 2.6% year-on-year in May, with further moderation expected as home prices fall and new rents remain soft. They warn that monthly inflation data will be closely watched for any signs of tariff impact, but for now, the trend remains downward.

With inflation cooling faster, and markets betting the rate-cut cycle to resume in September, Trump may not have long to wait for the monetary policy relief he's been loudly demanding.

Source: Investing.com

Treasury Secretary Scott Bessent expects a substantial drop in inflation during the first six months of 2026, according to statements made Tuesday on Fox Business. Bessent indicated that an announcem...

US retail sales were little changed in October as a decline at auto dealers and weaker gasoline receipts offset stronger spending in other categories. The value of retail purchases, not adjusted...

US job growth remained sluggish in November and the unemployment rate rose to a four-year high, pointing to a continued cooling in the labor market after a weak October. Nonfarm payrolls increas...

Nonfarm Payrolls (NFP) in the United States rose by 64,000 in November, according to a report from the U.S. Bureau of Labor Statistics (BLS) on Tuesday. This figure was better than market expectations...

Treasury Secretary Scott Bessent said there will be one or two more interviews this week for the next Federal Reserve chairman, with President Donald Trump likely announcing the next chairman sometime...

Gold prices extend gains, supported by expectations of further U.S. monetary easing, persistent geopolitical risks and strong investor demand. "While U.S. employment data was mixed, markets continue to see the Federal Reserve cutting its interest...

Stocks rose Wednesday after the S&P 500 posted a third losing session, as investors weighed newly released U.S. economic data. The S&P 500 traded 0.1% higher along with the Nasdaq Composite. The Dow Jones Industrial Average climbed 146...

Fed Governor Christopher Waller said Wednesday that the Fed is in no rush to cut interest rates, given the current outlook, according to Reuters. Key points: "The job market is very weak, job growth is not good right now." "The Fed's rate cuts...

New York Federal Reserve President John Williams said on Monday the U.S. central bank's interest rate cut last week leaves it in a good position to...

New York Federal Reserve President John Williams said on Monday the U.S. central bank's interest rate cut last week leaves it in a good position to...

Stocks rose Monday led by a broad array of names as traders bet data set for release this week will point to tame inflation and strong economic...

Stocks rose Monday led by a broad array of names as traders bet data set for release this week will point to tame inflation and strong economic...

Asian markets opened lower in the last full trading week of 2025, fueled by concerns about the prospects for tech company profits and growing AI...

Asian markets opened lower in the last full trading week of 2025, fueled by concerns about the prospects for tech company profits and growing AI...

Pasangan mata uang EUR/USD mengawali pekan ini dengan nada sedikit melemah di sesi Asia, diperdagangkan di sekitar 1,1730, turun kurang dari 0,10%...

Pasangan mata uang EUR/USD mengawali pekan ini dengan nada sedikit melemah di sesi Asia, diperdagangkan di sekitar 1,1730, turun kurang dari 0,10%...