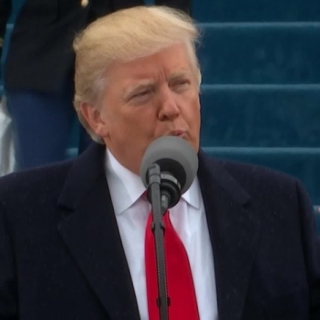

Industry executives are warning that U.S. President Donald Trump's recent 50% tariffs on aluminum imports may be too much for consumers to swallow and could destroy demand.

"We're concerned about the potential demand destruction" of the levies, especially at current levels, Derek Prichett, senior vice president of global metals at Novelis Inc., said at the 17th Harbor Aluminum summit in Chicago.

"Overall, it's a drag," Prichett said, adding that his company's Canadian-U.S. operations have been particularly affected by the tariffs. The Atlanta, Georgia-based company is the largest maker of flat-rolled aluminum products used in a variety of industries, including automotive and aerospace.

Trump has said the tariffs are necessary to protect domestic producers' profit margins and spur investment in U.S. manufacturing. But the U.S. is heavily dependent on imports to make everything from beverage cans to cars and airplanes.

Read More: Trump Signs Order Doubling U.S. Steel, Aluminum Tariffs to 50%

Many executives say manufacturers may not be able to absorb the high level of levies, which Trump doubled from 25% earlier this year. The levies, they say, will make products more expensive for Americans. Hisham Alkooheji, chief marketing officer at Aluminum Bahrain BSC, called the 50% tariffs — which take effect June 4 — a "real tipping point" because it will be difficult to pass on the cost to consumers.

Trump's aggressive and ever-changing tariff moves have also led to increased volatility in the metals market. After Trump's tariff doubling announcement Friday, contracts tied to the price producers pay to ship aluminum to the Midwest jumped 54% to their highest since 2013 on the Comex in New York on Monday and were trading near that level on Wednesday. (alg)

Source: Bloomberg

The United States ordered a blockade of Venezuelan oil tankers because the Trump administration believes President Nicolás Maduro's regime is acting detrimentally to the United States and the world. T...

Treasury Secretary Scott Bessent expects a substantial drop in inflation during the first six months of 2026, according to statements made Tuesday on Fox Business. Bessent indicated that an announcem...

US retail sales were little changed in October as a decline at auto dealers and weaker gasoline receipts offset stronger spending in other categories. The value of retail purchases, not adjusted...

US job growth remained sluggish in November and the unemployment rate rose to a four-year high, pointing to a continued cooling in the labor market after a weak October. Nonfarm payrolls increas...

Nonfarm Payrolls (NFP) in the United States rose by 64,000 in November, according to a report from the U.S. Bureau of Labor Statistics (BLS) on Tuesday. This figure was better than market expectations...

The United States ordered a blockade of Venezuelan oil tankers because the Trump administration believes President Nicolás Maduro's regime is acting detrimentally to the United States and the world. Trump has labeled the Venezuelan government a...

Gold prices extend gains, supported by expectations of further U.S. monetary easing, persistent geopolitical risks and strong investor demand. "While U.S. employment data was mixed, markets continue to see the Federal Reserve cutting its interest...

Stocks rose Wednesday after the S&P 500 posted a third losing session, as investors weighed newly released U.S. economic data. The S&P 500 traded 0.1% higher along with the Nasdaq Composite. The Dow Jones Industrial Average climbed 146...

New York Federal Reserve President John Williams said on Monday the U.S. central bank's interest rate cut last week leaves it in a good position to...

New York Federal Reserve President John Williams said on Monday the U.S. central bank's interest rate cut last week leaves it in a good position to...

Stocks rose Monday led by a broad array of names as traders bet data set for release this week will point to tame inflation and strong economic...

Stocks rose Monday led by a broad array of names as traders bet data set for release this week will point to tame inflation and strong economic...

Asian markets opened lower in the last full trading week of 2025, fueled by concerns about the prospects for tech company profits and growing AI...

Asian markets opened lower in the last full trading week of 2025, fueled by concerns about the prospects for tech company profits and growing AI...

Pasangan mata uang EUR/USD mengawali pekan ini dengan nada sedikit melemah di sesi Asia, diperdagangkan di sekitar 1,1730, turun kurang dari 0,10%...

Pasangan mata uang EUR/USD mengawali pekan ini dengan nada sedikit melemah di sesi Asia, diperdagangkan di sekitar 1,1730, turun kurang dari 0,10%...