Oil prices fell sharply in Asian trade on Monday, extending recent declines after U.S. President Donald Trump largely doubled-down on his recent trade tariffs, ramping up concerns over slowing economic growth and weakening demand.

China- the world's biggest oil importer- retaliated against Trump's tariffs over the weekend, while other majors such as the European Union outlined plans for retaliation, driving up concerns over a global trade war.

This notion had battered oil prices through the last week, as traders feared worsening economic growth, which could in turn dent global oil demand.

Brent oil futures fell 2.5% to $63.93 a barrel- their weakest level since April 2021, while West Texas Intermediate crude futures fell 2.4% to $60.16 a barrel by 21:31 ET (01:31 GMT).

Trump doubles down on tariffs, no deals until trade deficit fixed

Trump told reporters on Sunday evening that markets will have to treat the tariffs as "medicine," and that he had no plans to back off on his tariff plans.

Trump's recently unveiled round of reciprocal tariffs- which outline duties as high as 54% against China- are set to take effect from April 9.

The U.S. President said the tariffs were aimed at fixing the U.S. trade deficit with other major economies, and will remain in place until the deficit is "cured."

China retaliated against Trump's duties with 34% tariffs on all U.S. imports, while also decrying Trump's tariffs and threatening more measures.

Traders fear that Trump's tariffs will spark economic carnage across the globe, undermining growth and denting demand for oil.

Top oil importer China is also expected to be the worst hit by the new tariffs, which amount to a cumulative 54%.

Goldman Sachs slashes oil price forecasts on tariff jitters

Goldman Sachs had last week cut its 2025 Brent price average by 5.5% to $69/barrel, while WTI prices are expected to average at $66/barrel.

The investment bank cited heightened risks to oil from a brewing global trade war, which could trigger a recession.

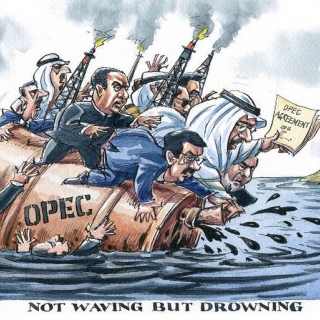

Goldman Sacha also warned that any measures by the Organization of Petroleum Exporting Countries and allies (OPEC+), to increase production, stood to dent oil prices.

Several OPEC+ members recently outlined plans to increase production in May, catching markets off guard and raising concerns over even greater supplies in the coming months.

Oil was also spooked last week by data showing a substantially bigger-than-expected build in U.S. inventories.

Source: Investing.com

Oil prices stabilized on Thursday (February 12th), as the market reassigned a risk premium to US-Iran tensions despite US inventory data showing swelling domestic supplies. This movement confirms one ...

Oil prices rose on Wednesday (February 11th), supported by a combination of geopolitical risk premiums from US-Iran tensions and more solid Asian demand signals particularly from India which helped ea...

Oil remained in the green zone on Tuesday (February 10th), as the market refused to abandon the Middle East risk premium. As of 13:07 GMT (20:07 WIB), Brent rose +0.4% to $69.32/barrel, while WTI rose...

Oil prices fell about 1% on Monday as concerns about conflict in the Middle East eased slightly. The market calmed after the US and Iran agreed to resume talks on Tehran's nuclear program, reducing fe...

Oil prices moved slightly higher in a volatile session on Friday, as investors assessed the direction of nuclear negotiations between the United States and Iran. Price movements appeared sensitive to ...

Oil prices stabilized on Thursday (February 12th), as the market reassigned a risk premium to US-Iran tensions despite US inventory data showing swelling domestic supplies. This movement confirms one thing: geopolitical headlines are still more...

Gold prices weakened slightly on Thursday (February 12th), as more solid US employment data reduced market confidence in an imminent Federal Reserve interest rate cut. The strong employment data prompted market participants to shift expectations of...

The Hang Seng Index reversed its downward trend in Hong Kong on Thursday (February 12th), weakening by around 0.9% to around 27,000 after a strong session earlier. This decline halted the momentum of the short term rally, as investors began to...