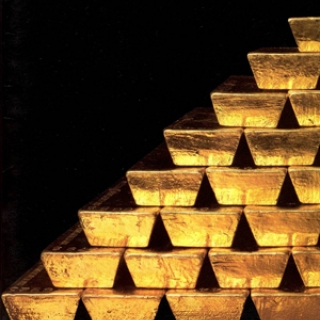

Gold (XAU/USD) attracted some dip buyers near $2,655 levels on Thursday and re-emerged near four-week highs touched the previous day. Cautious market sentiment, geopolitical risks, and concerns over US President-elect Donald Trump's tariff plans turned out to be key factors supporting the safe-haven commodity.

Further, the flight to safety triggered a modest pullback in the US Treasury bond yields and drove some flows towards the precious metal for the third straight day.

Meanwhile, the Federal Reserve's (Fed) hawkish signal that it will slow the pace of interest rate cuts in 2025 helped the US Dollar (USD) hold firm near two-year highs touched last week.

This might hold traders from placing aggressive bullish bets around the non-yielding Gold prices.

Investors might also prefer to wait for the release of the US Nonfarm Payrolls (NFP) report on Friday. Moreover, the mixed fundamental backdrop warrants some caution before positioning for any further gains.

Source: FXStreet

Gold prices briefly caused a stir after hitting a new record, but then slowed. The main trigger: US President Donald Trump withheld the threat of tariffs on Europe and claimed there was a "framework" ...

Gold prices hit another record high, while silver held near its all-time high. This rise was driven by two major factors: the escalating Greenland crisis and turmoil in the Japanese government debt ma...

Gold prices remained near all-time highs on Tuesday, hovering around $4,670 per ounce. Demand for safe haven assets remained strong as US-European trade tensions escalated, prompting investors to refr...

Gold and silver hit new records after US President Donald Trump threatened to impose tariffs on eight European countries that oppose his Greenland plan. This situation immediately pushed investors int...

Gold price rises on Friday, poised to end with weekly gains of nearly 4% as an employment report in the US was mixed, with the economy adding fewer jobs than projected. Still, the Unemployment Rate ti...

Gold prices briefly caused a stir after hitting a new record, but then slowed. The main trigger: US President Donald Trump withheld the threat of tariffs on Europe and claimed there was a "framework" for a future agreement on Greenland. This calmer...

Oil prices were little changed in Asian trading on Thursday after US President Donald Trump backed down from a threat to impose tariffs on European countries over Greenland. This decision helped ease geopolitical tensions and improve market...

The Nikkei 225 Index climbed 1.73% to close at 53,689, while the broader Topix Index rose 0.74% to 3,616 on Thursday, snapping a five-day losing streak as Japanese shares were lifted by a strong rally in chip and artificial intelligence related...