Hong Kong stocks were back in the red Friday as markets digested news of a softening U.S. job market and an unexpected decline in China's export figures. The Hang Seng Index decreased by around 244.07 points, or roughly 0.9%, to end at 26,241.83. The Hang Seng China Enterprises Index fell around 88.41 points, or 0.9%, to 9,267.56. China's exports in October slipped 1.1% year on year in US dollar terms to $305.4 billion, missing a consensus estimate of a 2.9% increase, according to a Bloomberg survey, the South China Morning Post reported. The contraction could signal a worsening outlook...

US stocks fell on Thursday, with the three major indexes down nearly 0.3%, as investors digested a slew of economic data and concerns about the economic outlook resurfaced. Retail sales rose 0.1% in April, compared with expectations for no change. However, core retail sales, which are more directly linked to GDP, fell 0.3%. Meanwhile, producer prices unexpectedly fell 0.5%, driven largely by a decline in margins, suggesting companies may be absorbing some cost pressures from higher tariffs. Energy, consumer goods and health care were the biggest losers. Apple shares fell 0.2% after President...

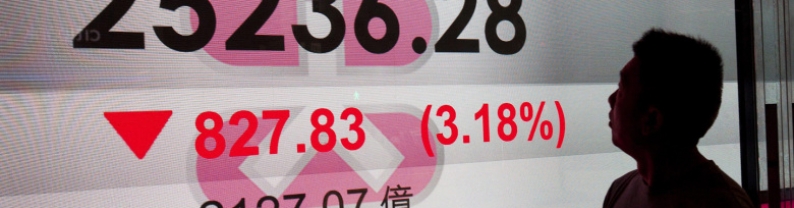

The Hang Seng fell 187 points or 0.8% to close at 23,453 on Thursday, reversing early gains and pulling back from a strong rally in the previous session. All sectors declined, weighed by tech, property, and consumer stocks. Sentiment weakened as mainland Chinese markets turned lower after a three-day bullish mood. Caution also grew after Wednesday's data showed a plunge to a 20-year low in China's new bank loans for April, reflecting weak demand and ongoing pressure from the U.S.–China trade tensions. Even news that Beijing had rolled back a rare earth export ban amid easing trade disputes...

European stocks opened firmly in negative territory as investors digested earnings updates from a number of companies across the continent. The Stoxx Europe 600 and France's CAC 40 were down 0.4%, while the U.K.'s FTSE 100 and Germany's DAX were down 0.5% as of 8:25 a.m. in London. Elsewhere in the currency market, the British pound gained 0.2% after better-than-expected U.K. gross domestic product figures for the first quarter. Shares of German industrial giant Thyssenkrupp plunged 8% shortly after the opening bell Thursday, sending the company to the bottom of the regional Stoxx 600...

Japanese stocks fell after the close on Thursday (5/15), as losses in the Paper & Pulp, Transportation and Communications sectors led shares lower. At the close in Tokyo, the Nikkei 225 was down 0.88%. The best performers on the Nikkei 225 were Taiyo Yuden Co., Ltd. (TYO:6976), which rose 6.77% or 159.50 points to trade at 2,514.00 at the close. Meanwhile, Aozora Bank, Ltd. (TYO:8304) gained 5.75% or 114.50 points to close at 2,105.50 and Haseko Corp. (TYO:1808) gained 4.77% or 95.50 points to 2,098.50 in late trade. The worst performers on the session were Rakuten Inc (TYO:4755),...

Hong Kong shares rose 56 points, or 0.2%, to 23,691 during the morning session on Thursday (May 15), marking a second straight day of gains. Traders reacted to Beijing's decision to lift export curbs on rare earths and military-use technology for 28 U.S. entities, effective Wednesday, allowing exporters to apply for licenses for a 90-day period. China also temporarily lifted trade and investment bans on 17 U.S. companies, which it called a potential step to restart bilateral ties. Locally, Financial Secretary Paul Chan said Hong Kong's interest rates may remain low due to ample liquidity,...