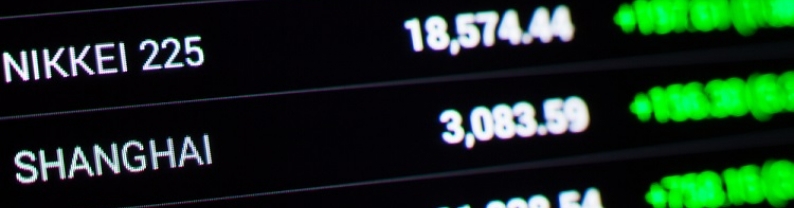

Asia-Pacific markets opened mostly higher Friday, tracking Wall Street gains as investors shrugged off the U.S. government shutdown. Investors are waiting to see how long the shutdown will last to assess the gravity of its economic repercussions. Historically, government shutdowns in the U.S. have not been market-moving events. Japan's September unemployment rate rose to 2.6%, government data showed Friday, higher than the 2.4% expected by economists polled by Reuters. The latest reading compared with the 2.3% unemployment rate in August. The country's September manufacturing purchasing...

European shares rose on Monday, extending the strong momentum from last week on optimism over a potential Ukraine peace deal, while investors turned their attention to upcoming U.S. inflation data and tariff negotiations later in the week. The pan-European STOXX 600 index was up 0.3% by 0708 GMT, hovering near its strongest level since July 31. Ukrainian President Volodymyr Zelenskiy won diplomatic backing from Europe and the NATO alliance ahead of a Russia-U.S. summit this week, where Kyiv fears Russian President Vladimir Putin and U.S. President Donald Trump may try to dictate terms for...

The Hang Seng Index opened 87 points higher, or 0.35%, at 24,946 points, while the National Enterprises Index rose by 23 points, or 0.26%, to 8,918 points. The Technology Index increased by 10 points, or 0.19%, to 5,470 points. In the technology sector, Alibaba saw a rise of 1.46%, Meituan gained 0.25%, and Kuaishou added 0.19%. Conversely, Xiaomi declined by 0.39%, and Tencent remained unchanged. Source : Dimsumdaily.hk

US stocks closed higher on Friday, with the S&P 500 up 0.8%, and the Nasdaq climbing nearly 1%, while the Dow gaining 206 points. Technology shares, led by Apple which surged 4.2% following its announcement of a $600 billion US investment plan helped lift the tech-heavy Nasdaq to new intraday highs. Investor optimism was also fueled by expectations of Federal Reserve rate cuts, with President Trump nominating Stephen Miran to the Fed Board, signaling possible shifts in monetary policy, despite concerns over new tariffs imposed by the Trump administration on imports from multiple...

European stocks closed firmly higher to record sharp gains in the first week of August as markets continued to assess the outlook of the European economy amid uncertain tariff levels by the US and policy reactions by the ECB. The Eurozone's STOXX 50 gained 0.4% to 5,354, a 3.6% gain on the week, while the pan-European STOXX 600 advanced 0.3% to 547, a 2.2% rise on the week. Banks continued to rise sharply in the session with BBVA, BNP Paribas, and UniCredit each gaining more than 2%. In the meantime, Siemens advanced 2.2% following a volatile week while Volkswagen, Mercedes-Benz, and...

U.S. stocks edged higher Friday as investors digested Trump's new selection to temporarily fill a vacancy on the Fed's Board of Governors and assessed an ebbing stream of corporate earnings. At 09:35 ET (13:35 GMT), the Dow Jones Industrial Average rose 145 points, or 0.3%, the S&P 500 index gained 16 points, or 0.3%, and the NASDAQ Composite climbed 52 points, or 0.3%. The main averages are on pace for weekly gains, with the tech-heavy NASDAQ Composite the star of the show, poised for a 2.9% gain before this session. The Trump administration's tariffs took effect from Thursday,...