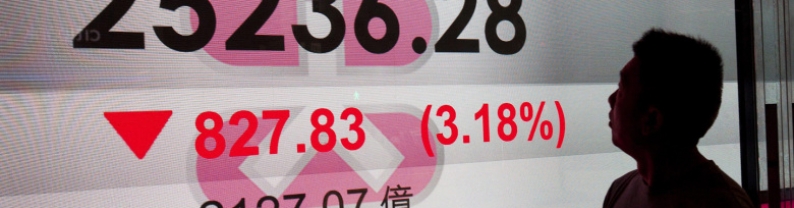

Hong Kong stocks were back in the red Friday as markets digested news of a softening U.S. job market and an unexpected decline in China's export figures. The Hang Seng Index decreased by around 244.07 points, or roughly 0.9%, to end at 26,241.83. The Hang Seng China Enterprises Index fell around 88.41 points, or 0.9%, to 9,267.56. China's exports in October slipped 1.1% year on year in US dollar terms to $305.4 billion, missing a consensus estimate of a 2.9% increase, according to a Bloomberg survey, the South China Morning Post reported. The contraction could signal a worsening outlook...

The Nikkei 225 and Topix indexes rallied nearly 2% on Wednesday, with the latter reaching one-year highs after US President Donald Trump announced a trade agreement with Japan that includes a 15% tariff on Japanese exports to the US. Trump also revealed that Japan will invest $550 billion into the US and open its markets to key American goods. The news sparked broad-based gains, led by Japanese automakers. Toyota Motor jumped 9.8%, Honda Motor rose 8.8%, and Nissan Motor climbed 9%. Financials, industrials, and consumer stocks also posted strong advances, reflecting optimism over improved...

Asia-Pacific markets opened higher after U.S. President Donald Trump announced that he had completed a "massive Deal" with Japan, which set tariffs of 15% on the country's exports to the U.S. Overnight, the U.S. benchmark S&P 500 rose to another record high. Japan's benchmark Nikkei 225 rose 1.71% at the open, while the Topix climbed 1.87% as of 9.09 a.m. Japan time (8.09 p.m. ET Tuesday). South Korea's Kospi added 0.89% and the small-cap Kosdaq was 0.22% higher. Australia's S&P/ASX 200 rose 0.34%. Source: CNBC

US stocks closed mixed on Tuesday (July 22nd), as the S&P 500 hit a new record, rising nearly 0.1%, the Dow Jones Industrial Average rose 170 points, and the Nasdaq 100 fell 0.5% ahead of key earnings reports from Alphabet and Tesla. Chip stocks weighed on the Nasdaq, with Nvidia down 2.4% and Broadcom down 3.3% following reports that SoftBank and OpenAI's massive AI project was stalled. Shares of Lockheed Martin (-10.8%) and Philip Morris (-8.2%) fell sharply after disappointing results. General Motors (-8%) also warned of a deeper impact on profits related to tariffs after a 32%...

European stocks closed lower for a third session amid persistent concerns about US tariffs. The Eurozone STOXX 50 index fell 1% to 5,288, and the pan-European STOXX 600 index fell 0.5% to 544. US Treasury Secretary Bessent noted that White House officials were prioritizing trade agreements they considered beneficial rather than rushing to reach a deal before the August 1 deadline, which could potentially pave the way for the imposition of 30% tariffs on the EU before negotiations conclude. Defense stocks were among the biggest decliners, with Rheinmetall, BAE Systems, and Thales falling...

The S&P 500 fell on Tuesday, a day after the broad market index and Nasdaq Composite hit fresh records, as traders weighed the latest earnings reports and new trade developments. The S&P 500 ticked lower by 0.3%, while the Nasdaq slipped 0.9%. The Dow Jones Industrial Average rose 74 points, or 0.2%. Shares of aerospace and defense name Lockheed Martin were down almost 7% after the company's revenue for the second quarter missed analyst estimates. Similarly, Philip Morris lost 6% after the tobacco company's second-quarter revenue also missed expectations. So far, 88 S&P 500...