Hong Kong stocks were back in the red Friday as markets digested news of a softening U.S. job market and an unexpected decline in China's export figures. The Hang Seng Index decreased by around 244.07 points, or roughly 0.9%, to end at 26,241.83. The Hang Seng China Enterprises Index fell around 88.41 points, or 0.9%, to 9,267.56. China's exports in October slipped 1.1% year on year in US dollar terms to $305.4 billion, missing a consensus estimate of a 2.9% increase, according to a Bloomberg survey, the South China Morning Post reported. The contraction could signal a worsening outlook...

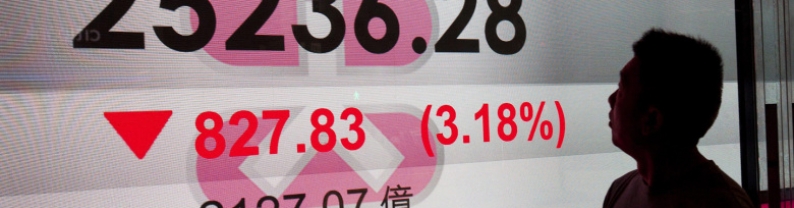

Following a four-day winning streak, Hong Kong's stock market saw a slight correction on Thursday morning (24th July). The Hang Seng Index opened 9 points lower, down 0.04%, at 25,528 points. Meanwhile, the China Enterprises Index fell by 15 points, or 0.17%, to 9,225 points, and the Hang Seng Tech Index dropped 14 points, or 0.26%, to 5,730 points. Financial stocks showed mixed performances. AIA Group rose 0.21%, while Ping An Insurance and Hong Kong Exchanges and Clearing remained unchanged. HSBC Holdings climbed 0.8%, trading at HK$100.8. Among major tech stocks, Meituan fell 0.15%,...

The Nikkei 225 Index rallied 1.1% to above 41,600 while the broader Topix Index jumped 1.5% to 2,970 on Thursday, with the latter reaching all-time highs as the recently announced trade deal with the US and Japan continued to support market momentum. Japan now faces a 15% tariff on its exports to the US, lower than the 25% levy that Trump threatened in a letter earlier this month. Global sentiment improved further on reports of progress in US-EU trade talks. On the domestic front, data showed that Japan's private sector growth held steady in July, with continued strength in services...

Asia-Pacific markets opened higher as the latest trade developments between the U.S. and Japan, as well as positive signs for a deal with the European Union, spurred investor optimism. Overnight in the U.S., the S&P 500 climbed 0.78% to a record close of 6,358.91 — its 12th of the year. Japan's broad-based Topix rose 1.2% to hit a record high in early Asia trading hours, data from LSEG showed. The benchmark Nikkei 225 rose 1.09%, extending gains from Wednesday following the announcement of Japan's trade deal with the U.S. South Korea's Kospi rose 1.17% at the open, and the Kosdaq...

US stocks rallied on Wednesday (July 23), driven by optimism over a new trade agreement and strong corporate momentum. The S&P 500 rose 0.8% to a new record high, while the Nasdaq gained 0.7%. The Dow Jones Industrial Average surged 505 points, nearly reaching its own record high. The market welcomed news of a finalized trade deal between the US and Japan that includes reciprocal tariffs of 15%, with President Trump signaling similar progress in negotiations with the European Union. Reports suggesting a US-EU deal is nearing completion, mirroring Japan's framework, further boosted...

European stocks closed sharply higher on Wednesday (July 23), halting three previous trading sessions' declines, buoyed by speculation that the US might accept lower tariffs following a new trade deal with Japan. The Eurozone STOXX 50 rose 1.1% to 5,350, and the pan-European STOXX 600 gained 1.1% to 550. President Trump lowered tariffs on Japan to 15% from an initial threat of 25%, despite no reports of substantial progress in trade negotiations between the EU and the US. Progress on auto tariffs with Japan, which has significant exposure to automakers, lifted shares of BMW, Stellantis,...