Hong Kong stocks were back in the red Friday as markets digested news of a softening U.S. job market and an unexpected decline in China's export figures. The Hang Seng Index decreased by around 244.07 points, or roughly 0.9%, to end at 26,241.83. The Hang Seng China Enterprises Index fell around 88.41 points, or 0.9%, to 9,267.56. China's exports in October slipped 1.1% year on year in US dollar terms to $305.4 billion, missing a consensus estimate of a 2.9% increase, according to a Bloomberg survey, the South China Morning Post reported. The contraction could signal a worsening outlook...

The Nikkei 225 fell 0.9% to below 40,700, while the broader Topix Index declined 0.8% to 2,908 on Tuesday, marking a third straight session of losses for Japanese equities. The initial optimism from recent trade agreements began to wane, and investors turned their focus to the ongoing US-China trade talks in Stockholm. Attention also shifted to a busy week of domestic corporate earnings, with major firms such as Advantest, Keyence, Tokyo Electron, Nintendo, ANA Holdings, and Japan Airlines scheduled to report. Technology stocks led the retreat, with notable losses from Disco (-1.4%),...

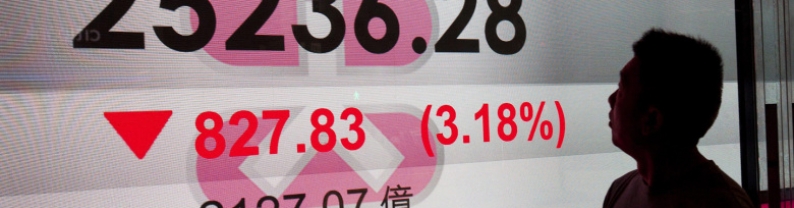

Asia-Pacific markets fell as investors awaited the outcome of the ongoing U.S.-China trade talks. Investors also await the result of the U.S. Federal Reserve meeting due Wednesday stateside, where it will make a decision on whether to cut interest rates. Japan's benchmark Nikkei 225 was set to open lower, with the futures contract in Chicago at 40,920 while its counterpart in Osaka last traded at 40,820, against the index's last close of 40,998.27. Futures for Hong Kong's Hang Seng Index stood at 25,367, pointing to a weaker open compared with the HSI's last close of...

The Dow Jones Industrial Average (DJIA) tested all-new record highs early Monday, clipping into the high side in early trading before the weight of the upcoming week pushed investors back into familiar territory. A handful of Magnificent Seven (Mag7) companies will be posting their latest quarterly earnings this week, adding further high-impact events to an already burgeoning data docket. Dow Jones price forecastThe Dow Jones clipped a record high in intraday trading on Monday, tapping 45,130 for the first time ever before slumping back into last week's congestion. The DJIA is now battling...

Europe's Stoxx 600 index erased earlier gains to close 0.23% lower as investors turned less positive over the details of the U.S.-EU trade deal. Autos was among the worst-performing sectors, down 1.8%, as industry bosses warned that while manufacturers have regained some certainty, they will be left facing substantially higher costs. Brewing giant Heineken dropped 8.45% after reporting lower beer sales in the first half and flagging "softening sentiment in Europe and the Americas." Oil and gas stocks meanwhile finished 1.16% higher on broader optimism over the global trade outlook, and as...

The Hang Seng rose 174 points or 0.7% to close at 25,562 on Monday, rebounding from losses in the prior session amid broad-based gains, led by financials and property stocks. Sentiment improved as the U.S. and China were set to resume trade talks in Stockholm, with reports suggesting a likely three-month extension of their tariff truce. Markets were near their highest in four years, lifted by news about the U.S.–EU trade deal, which set a 15% tariff on most EU goods, half the previously threatened rate. However, gains were capped by caution ahead of Hong Kong's June trade data due later...