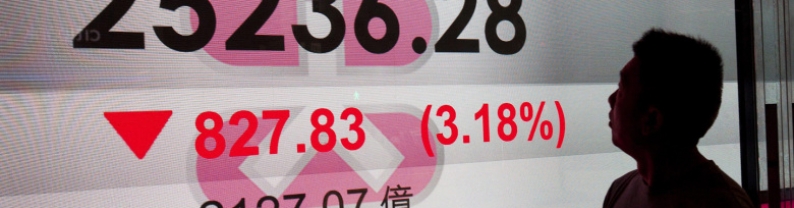

Hong Kong stocks were back in the red Friday as markets digested news of a softening U.S. job market and an unexpected decline in China's export figures. The Hang Seng Index decreased by around 244.07 points, or roughly 0.9%, to end at 26,241.83. The Hang Seng China Enterprises Index fell around 88.41 points, or 0.9%, to 9,267.56. China's exports in October slipped 1.1% year on year in US dollar terms to $305.4 billion, missing a consensus estimate of a 2.9% increase, according to a Bloomberg survey, the South China Morning Post reported. The contraction could signal a worsening outlook...

A historic stock market rally stalled as President Donald Trump's latest tariff warnings did little to bolster sentiment as investors braced for the economic and corporate earnings effects of his trade war. Even data showing a pickup in U.S. service provider growth failed to lift sentiment, with the S&P 500 snapping its longest winning streak in about 20 years. While Trump hinted some sort of trade deal could be reached this week, he signaled no immediate deal with China. As the president expanded his restrictions on U.S. imports to entertainment, shares of companies such as Netflix...

European stocks opened mixed on Monday, with U.K. markets closed for a bank holiday, as investors awaited fresh economic data and corporate earnings reports due later in the week. Germany's DAX was last up 0.22%, while Italy's FTSE MIB traded around the flatline and France's CAC 40 fell 0.43%. Santander announced Monday that Austria's Erste Group Bank has acquired about a 49% stake in Poland-based Santander Bank Polska and 50% of Polish asset manager Santander TFI. Erste Group shares were last up about 6.2%. Data released Monday showed that Swiss inflation fell to 0% in April from the...

US stocks rose on Friday, boosted by a strong jobs report and signs of easing U.S.-China trade tensions that boosted investor confidence. The S&P 500 rose nearly 1.5%, marking its ninth straight gain and its longest winning streak in two decades. The Dow Jones Industrial Average jumped 563 points, also extending its rally to a ninth straight session, while the Nasdaq gained 1.5%. April nonfarm payrolls rose by 177,000, beating expectations and bolstering optimism about the labor market despite ongoing tariff uncertainty. Sentiment was further buoyed by Beijing's openness to fresh trade...

European stocks rose on Friday, boosted by stronger-than-expected U.S. payrolls data for April and signs that China may resume trade talks with the U.S. The Stoxx 50 jumped 1.9% and the Stoxx 600 gained 1.7%, led by a 3% rally in technology stocks. London's FTSE 100 rose more than 1%, marking its longest daily winning streak on record. Shell rose 1.9% after beating Q1 profit expectations and launching a $3.5 billion share buyback. Standard Chartered also beat estimates, boosted by gains in wealth management and global banking, while NatWest reported better-than-expected profit of £1.8...

US stocks were firmly higher on Friday after evidence of a strong labor market softened concerns of a recession this year. The S&P 500, the Dow, and the Nasdaq 100 were all above 1% higher, with the former two set to record a nine-session win streak. The US added 177 thousand jobs in April, more than expectations of 130 thousand, while the unemployment rate remained unchanged and wages grew loosely in line with expectations. The stronger momentum was also owed to China noting that it will consider starting talks with the White House on potential trade deals. Gains were broad-based...