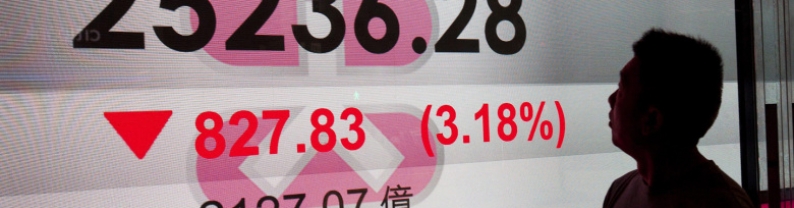

Hong Kong stocks were back in the red Friday as markets digested news of a softening U.S. job market and an unexpected decline in China's export figures. The Hang Seng Index decreased by around 244.07 points, or roughly 0.9%, to end at 26,241.83. The Hang Seng China Enterprises Index fell around 88.41 points, or 0.9%, to 9,267.56. China's exports in October slipped 1.1% year on year in US dollar terms to $305.4 billion, missing a consensus estimate of a 2.9% increase, according to a Bloomberg survey, the South China Morning Post reported. The contraction could signal a worsening outlook...

Silver prices slipped to around $33.30 per ounce on Friday, paring gains from earlier in the week as signs of easing in global trade tensions lifted the dollar, pressuring greenback-denominated commodities. The dollar strengthened as US President Donald Trump claimed that trade talks with China are ongoing, with additional signs of progress in negotiations with Japan and South Korea further boosting investor sentiment. China is also reportedly considering waiving its 125% tariff on certain US goods, raising hopes of further de-escalation in the trade war. Moreover, Trump made a u-turn on...

Oil prices rose for a second session on Friday buoyed by potential de-escalation of the U.S.-China trade war, but the market was headed for a weekly decline amid concerns about oversupply. Brent crude futures gained 43 cents to $66.98 a barrel by 0433 GMT, on track to fall 1.4% for the week. U.S. West Texas Intermediate (WTI) crude rose 42 cents to $63.21 a barrel but was set to decline 2.3% for the week. "For today, oil prices are slightly up as the market responds to signs of easing tensions around Trump's tariffs and a potential shift in the Fed's policy stance, contributing to a...

The US Dollar Index (DXY), an index of the value of the US Dollar (USD) measured against a basket of six world currencies, edges higher to near 99.75 during the early European session on Friday amid positive developments in negotiations with allies India, Japan and South Korea. Investors brace for the final reading of the US Michigan Consumer Sentiment, which is due later on Friday. US Treasury Secretary Scott Bessent has suggested that India is likely to become the first country to finalise a bilateral trade agreement with the US to avoid Trump's reciprocal tariffs on Indian exports....

The Japanese Yen (JPY) continues losing ground through the Asian session on Friday and drops to a nearly two-week low against its American counterpart in the last hour. Hopes for the potential de-escalation of trade war between the US and China remain supportive of a positive risk tone, which, in turn, is seen denting demand for the safe-haven JPY. Adding to this, the emergence of some US Dollar (USD) buying lifts the USD/JPY pair further beyond mid-143.00s. Meanwhile, government data showed that consumer inflation in Tokyo Japan's capital city – accelerated sharply in April and reaffirms...

Gold price (XAU/USD) attracts some sellers following an uptick to the $3,370-3,371 area during the Asian session on Friday and reverses a part of the previous day's positive move. Hopes for a potential de-escalation of trade war between the US and China remain supportive of a positive risk tone, which, in turn, is seen undermining the safe-haven precious metal. Apart from this, the emergence of some US Dollar (USD) buying turns out to be another factor exerting downward pressure on the commodity. Meanwhile, Federal Reserve (Fed) officials showed willingness for potential interest rate cuts,...