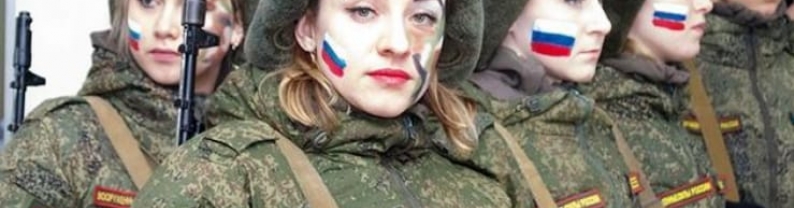

The U.S. and Russia are aiming to reach a deal to halt the war in Ukraine that would lock in Moscow's occupation of territory seized during its military invasion, Bloomberg News reported on Friday. U.S. and Russian officials are working towards an agreement on territories for a planned summit meeting between U.S. President Donald Trump and his Russian counterpart Vladimir Putin as early as next week, the report said, citing unnamed people familiar with the matter. A White House official said the Bloomberg story was speculation. A Kremlin spokesperson did not respond to a request for...

Hong Kong stocks fell 214 points, or 0.9%, to 23,241 on Friday, posting a second straight session of losses amid declines across all sectors. Investors were cautious ahead of key Chinese April data due next week, including industrial production, retail sales and home prices. Meanwhile, the People's Bank of China is set to review its benchmark lending rate, which has remained at a record low in recent months to support the struggling economy. Alibaba Group Hlds. plunged 4.9% after reporting disappointing quarterly earnings. Other big losers included Kuaishou (-3.0%), Meituan (-2.7%),...

The Nikkei 225 index fell 0.4% to around 37,600 while the broader Topix index fell 0.1% to 2,736 on Friday, with Japanese shares falling for a third straight session, weighed down by weaker-than-expected economic data and weak guidance from Wall Street. Investor sentiment soured after Japan's GDP contracted 0.2% quarter-on-quarter in the first quarter, marking the country's first economic contraction in a year and below forecasts for a 0.1% decline. The data reinforced concerns raised earlier this week by the Bank of Japan, which warned of a potential economic moderation amid the impact of...

The S&P 500 climbed for a fourth session, adding to this week's rally after the U.S. and China agreed to temporarily slash tariff rates. Treasury yields also fell, providing a tailwind to stocks. The broad market index added 0.4%, while the Nasdaq Composite slipped 0.2%. The Dow Jones Industrial Average added 271.69 points, or 0.7%. Confidence in the immediate outlook for stocks has strengthened in the wake of last weekend's talks between Treasury Secretary Scott Bessent and Chinese officials that appeared to stave off a short-term decline in economic activity and a ratcheting up in...

US stocks gained traction, benefiting from reprieve for Treasuries across the curve amid bets that the Federal Reserve will deliver multiple rate cuts this year. The S&P 500, the Nasdaq 100, and the Dow were all close to 0.5% higher. Fresh data showed that headline producer prices fell sharply in April to back the view of disinflation following the softer CPI print this week. Also, core sectors of retail sales unexpectedly contracted in the period, favoring bets that the Fed will adjust monetary policy to support the economy. Industrials, utilities, and pharmaceuticals led the gains. GE...

European stocks recovered from earlier losses to close above the flatline on Thursday, erasing the slight pullback from last session as markets digested a batch of earnings results and assessed how trade barriers may jeopardize economic growth. The Eurozone's STOXX 50 closed marginally higher at 5,410 and the pan-European STOXX 60 gained 0.5% to close at 546. Healthcare stocks rebounded as investors took advantage of lower valuations due to US President Trump's signals of caps on drug prices, lifting Bayer and Sanofi shares by 3% and 1%, respectively. Utilities also advanced sharply with...

China's official NBS Manufacturing PMI increased to 49.7 in June 2025 from May's 49.5, matching market expectations while marking the third consecutive month of contraction in factory activity.

It...

China's official NBS Manufacturing PMI increased to 49.7 in June 2025 from May's 49.5, matching market expectations while marking the third consecutive month of contraction in factory activity.

It...

Both the STOXX 50 and STOXX 600 hovered around the flatline on Friday, as investors adopted a cautious stance ahead of further developments in trade talks between US President Trump and Chinese...

Both the STOXX 50 and STOXX 600 hovered around the flatline on Friday, as investors adopted a cautious stance ahead of further developments in trade talks between US President Trump and Chinese...

New Delhi has put on hold its plans to procure new U.S. weapons and aircraft, according to three Indian officials familiar with the matter, in India's first concrete sign of discontent after tariffs...

New Delhi has put on hold its plans to procure new U.S. weapons and aircraft, according to three Indian officials familiar with the matter, in India's first concrete sign of discontent after tariffs...