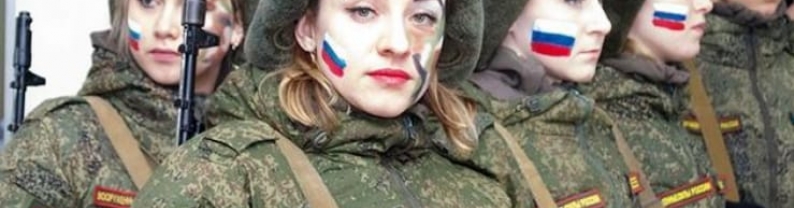

The U.S. and Russia are aiming to reach a deal to halt the war in Ukraine that would lock in Moscow's occupation of territory seized during its military invasion, Bloomberg News reported on Friday. U.S. and Russian officials are working towards an agreement on territories for a planned summit meeting between U.S. President Donald Trump and his Russian counterpart Vladimir Putin as early as next week, the report said, citing unnamed people familiar with the matter. A White House official said the Bloomberg story was speculation. A Kremlin spokesperson did not respond to a request for...

The Nikkei 225 Index dropped 1.1% to around 38,160, while the broader Topix Index fell 1.3% to 2,653 on Friday, marking their lowest levels in at least a month. The declines followed losses on Wall Street overnight, driven by a sell-off in megacap technology stocks. Investor focus shifted to the upcoming Bank of Japan monetary policy decision, as Governor Kazuo Ueda indicated on Wednesday that the central bank would consider raising interest rates at its next meeting. In corporate news, Nintendo saw a sharp 6% drop after announcing the launch of its Switch 2 console later this year. Other...

U.S. stocks dipped on Thursday as a jump in the prior session cooled, while investors eyed the most recent corporate earnings and gauged economic data to determine the path of Federal Reserve rate cuts. A benign reading on inflation calmed fears about a renewal in price pressures and strong bank earnings helped the three major U.S. indexes notch their biggest one-day percentage gain since Nov. 6 on Wednesday. Morgan Stanley (MS.N), advanced 4.03% after the lender said earnings increased in the fourth quarter, propelled by a wave of dealmaking, while Bank of America (BAC.N), shares declined...

European markets closed higher Thursday, with luxury stocks soaring on strong results from Cartier owner Richemont The regional Stoxx 600 index provisionally ended the day 0.93% higher, with most sectors in positive territory. Retail stocks pared earlier gains to fall 0.2%. Luxury sector bellwether Richemont jumped 16% after reporting a better-than-expected 10% increase in fiscal third-quarter sales, while France's LVMH, Kering and Christian Dior all rising. Retailers Moncler, Burberry, Swatch and Hermes also crowded around the top of the Stoxx index. Technology stocks closed 1.9% higher,...

US stocks rose slightly on Thursday, with the three major indexes up about 0.1%, following strong gains the previous day. Traders digested the latest economic data while remaining optimistic that the Federal Reserve has room to implement further interest rate cuts this year. Retail sales rose less than anticipated last month and initial claims came in above estimates. Tech stocks such as Nvidia (1.5%) and Super Micro Computer (2.7%) rose, supported by a positive outlook from Taiwan Semiconductor Manufacturing. Meanwhile, earnings season continued with Bank of America shares rising 0.1%...

The STOXX 50 rose 0.9% and the STOXX 600 gained 0.6% on Thursday, in line with a rise in global equities. The rally was driven by optimism following the U.S. CPI report, which reinforced expectations that the Federal Reserve has room to continue cutting interest rates this year. Meanwhile, traders were also focused on corporate results, with Richemont shares jumping more than 15% after the luxury company reported a 10% jump in Q3 sales. The luxury sector received a boost from the news, with LVMH (8%), Kering (9%), Moncler (7.6%) and Hermes (5.1%) surging. ASML Holding (3.5%), L'Oreal (2.6%)...

China's official NBS Manufacturing PMI increased to 49.7 in June 2025 from May's 49.5, matching market expectations while marking the third consecutive month of contraction in factory activity.

It...

China's official NBS Manufacturing PMI increased to 49.7 in June 2025 from May's 49.5, matching market expectations while marking the third consecutive month of contraction in factory activity.

It...

Both the STOXX 50 and STOXX 600 hovered around the flatline on Friday, as investors adopted a cautious stance ahead of further developments in trade talks between US President Trump and Chinese...

Both the STOXX 50 and STOXX 600 hovered around the flatline on Friday, as investors adopted a cautious stance ahead of further developments in trade talks between US President Trump and Chinese...

New Delhi has put on hold its plans to procure new U.S. weapons and aircraft, according to three Indian officials familiar with the matter, in India's first concrete sign of discontent after tariffs...

New Delhi has put on hold its plans to procure new U.S. weapons and aircraft, according to three Indian officials familiar with the matter, in India's first concrete sign of discontent after tariffs...