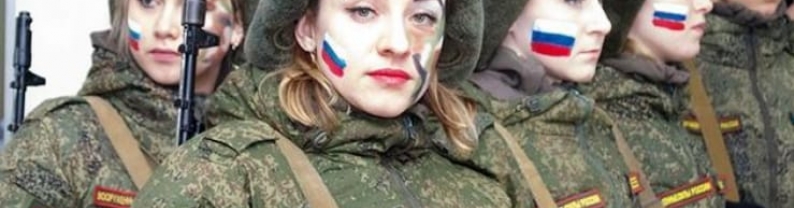

The U.S. and Russia are aiming to reach a deal to halt the war in Ukraine that would lock in Moscow's occupation of territory seized during its military invasion, Bloomberg News reported on Friday. U.S. and Russian officials are working towards an agreement on territories for a planned summit meeting between U.S. President Donald Trump and his Russian counterpart Vladimir Putin as early as next week, the report said, citing unnamed people familiar with the matter. A White House official said the Bloomberg story was speculation. A Kremlin spokesperson did not respond to a request for...

U.S. stocks rebounded on Tuesday, led by the Nasdaq's 1.5% surge, as technology shares recovered from Monday's AI-driven sell-off triggered by Chinese startup DeepSeek's announcement of a competitive AI model. Nvidia surged 8.8%, recovering part of its historic 17% single-session loss that erased $593 billion in market value. Broadcom and Oracle added 2.6% and 3.6%, respectively, amid broad tech strength. The S&P 500 climbed 0.9%, supported by its technology sector, while Appleand Microsoft advanced 3.7% and 2.9%, respectively ahead of its earnings release. Meanwhile, Royal Caribbean...

European stocks closed higher on Tuesday, rebounding from the losses in the previous session as markets continued to assess the outlook on GPU and AI infrastructure demand following yesterday's tech selloff. The Eurozone's STOXX 50 added 0.3% to close at 5,203 and the STOXX 600 closed 0.5% higher at a record high of 532. Selected tech stocks remained in the spotlight after claims from Chinese-developed LLM DeepSeek that it attains comparable results to US counterparts with a fraction of computing power triggered a selloff for companies with exposure to speculation of higher AI infrastructure...

Europe's major bourses tried to recover on Tuesday, with the STOXX 50 trading flat to higher and the STOXX 600 up 0.2%, following losses in the previous session, which were driven by concerns over rising AI competition from China that sparked a selloff in the tech sector. ASML Holding rose 0.5%, after dropping 7.5% on Monday, and Infineon rose 0.1%, after dropping 2%. Meanwhile, investors also turned their attention to corporate earnings. SAP shares rose about 2% after the company revised its operating profit outlook higher to €10.6 billion and said it met or exceeded all of its 2024...

The Hang Seng closed 0.14% higher at 20,225 on Tuesday (1/28) in a half-day session ahead of the Lunar New Year celebrations. The index marked its third straight session of gains, largely supported by technology advances and consumer spending. Traders were closely following developments on Chinese startup DeepSeek's affordable AI model, as its emergence raised concerns about U.S. dominance in the tech sector. China Vanke Co. jumped 2.1% after overhauling its management, following assurances from Chinese authorities to support the troubled builder. Xiaomi Corp. ended at a record high, jumping...

Japanese stocks fell after the close on Tuesday (1/28), as losses in the Nonmetallic Minerals, Communications and Electrical/Machinery sectors led shares lower. At the close in Tokyo, the Nikkei 225 was down 1.43%. The best performers on the Nikkei 225 were Sumitomo Realty & Development Co. (TYO:8830), which rose 5.12% or 263.00 points to trade at 5,395.00 at the close. Meanwhile, Nintendo Co Ltd (TYO:7974) rose 4.67% or 457.00 points to close at 10,250.00 and Oriental Land Co Ltd (TYO:4661) gained 4.14% or 146.00 points to 3,675.00 in late trade. The worst performers on the session...

China's official NBS Manufacturing PMI increased to 49.7 in June 2025 from May's 49.5, matching market expectations while marking the third consecutive month of contraction in factory activity.

It...

China's official NBS Manufacturing PMI increased to 49.7 in June 2025 from May's 49.5, matching market expectations while marking the third consecutive month of contraction in factory activity.

It...

Both the STOXX 50 and STOXX 600 hovered around the flatline on Friday, as investors adopted a cautious stance ahead of further developments in trade talks between US President Trump and Chinese...

Both the STOXX 50 and STOXX 600 hovered around the flatline on Friday, as investors adopted a cautious stance ahead of further developments in trade talks between US President Trump and Chinese...

New Delhi has put on hold its plans to procure new U.S. weapons and aircraft, according to three Indian officials familiar with the matter, in India's first concrete sign of discontent after tariffs...

New Delhi has put on hold its plans to procure new U.S. weapons and aircraft, according to three Indian officials familiar with the matter, in India's first concrete sign of discontent after tariffs...