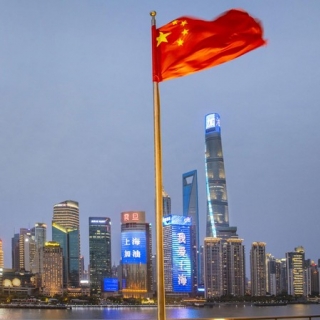

Asia-Pacific markets traded mixed Monday as China's central bank held rates at a time when the yuan has come under pressure due to Beijing-Washington trade tensions.

Mainland China's CSI 300 rose 0.18% after the People's Bank of China kept its key loan prime rates unchanged at 3.10% for 1-year loan maturities and 3.60% for 5-year loan maturities, in line with the expectations of economists polled by Reuters.

Japan's benchmark Nikkei 225 fell 1.24%, while the broader Topix index declined 1.18%.

In South Korea, the Kospi index was flat while the small-cap Kosdaq moved down 0.27% in choppy trade.

Australian and Hong Kong markets were closed for the Easter holiday.

Investors are focused on U.S. President Donald Trump's trade policies, as they continue to roil global markets.

Last week, Trump called for the U.S. Federal Reserve to cut interest rates while adding that the termination of Fed Chair Jerome Powell "cannot come fast enough." Trump's comments came after Powell cautioned that ongoing trade tensions could challenge the central bank's goals of controlling inflation and spurring growth.

U.S. futures fell after all three major benchmarks logged their third weekly decline, in the last four trading weeks.

The broad-based S&P 500 ended Thursday's session higher, but still finished the holiday-shortened week 1.5% lower.

Meanwhile, the Dow Jones Industrial Average and Nasdaq Composite posted their third consecutive losing session, each declining over 2% in the four-day trading week.

source: CNBC

Asia-Pacific markets rose Thursday following a tech rally overnight on Wall Street that lifted the S&P 500 and Nasdaq Composite, even as growing fears around the economy weighed on equities. Japa...

Wall Street ended mixed on Wednesday as tech strength offset broader market weakness, with investors weighing a favorable antitrust ruling for Google against signs of labor market softening. The S&am...

European shares ended higher on Wednesday, stabilising as investors assessed fiscal challenges after a selloff in longer-dated bonds had sparked risk-off sentiment in the previous session. The contin...

A rally in the world's largest tech companies drove stocks higher as bonds rebounded after weak jobs data validated wagers the Federal Reserve will resume cutting rates i...

European stocks traded higher on Wednesday, with the STOXX 50 up 0.7% and the STOXX 600 gaining 0.4%, rebounding after a 1.4% drop in the previous session. On Tuesday, equities retreated as concerns ...

The Nikkei 225 Index rose 1.53% to close at 42,580 while the broader Topix Index added 1.03% to 3,080 on Thursday, rebounding from the previous session's decline and tracking a tech-led rally on Wall Street. Gains were driven by Alphabet and Apple,...

Silver slipped 1% to around $40.7 per ounce on Thursday, easing from 14-year highs as investors locked in profits ahead of key US labor market releases. Precious metals have rallied in recent weeks as traders increased bets on Federal Reserve rate...

The Hang Seng Index opened up 145 points, or 0.57%, reaching 25,489 points. The National Enterprises Index gained 52 points, also up 0.57%, to stand at 9,102 points, while the Technology Index increased by 41 points, or 0.73%, to 5,725...

The US Bureau of Labor Statistics (BLS) will release the Job Openings and Labor Turnover Survey (JOLTS) on Wednesday. This publication will provide...

The US Bureau of Labor Statistics (BLS) will release the Job Openings and Labor Turnover Survey (JOLTS) on Wednesday. This publication will provide...

European bourses opened September in positive territory, with both the STOXX 50 and STOXX 600 rising nearly 0.3% after modest gains in August....

European bourses opened September in positive territory, with both the STOXX 50 and STOXX 600 rising nearly 0.3% after modest gains in August....

Global stocks fell and long-dated bond yields in Europe hit multiyear highs on Tuesday as investors grew increasingly worried about the state of...

Global stocks fell and long-dated bond yields in Europe hit multiyear highs on Tuesday as investors grew increasingly worried about the state of...

In his first press conference in a week, President Donald Trump dismissed rumors of his death circulating on social media. In a casual tone, Trump...

In his first press conference in a week, President Donald Trump dismissed rumors of his death circulating on social media. In a casual tone, Trump...