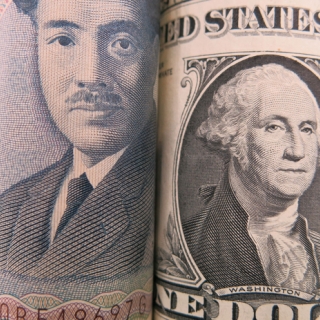

The US Dollar Index (DXY), a measure of the value of the US Dollar (USD) against a basket of six major currencies, attracted some buyers around 103.50 during the early European session on Wednesday (3/19). Traders are preparing for the Federal Reserve's (Fed) interest rate decision later on Wednesday, with no change in interest rates expected.

Fed officials' fresh economic projections will be closely watched as they could provide some clues on how policymakers view the possible impact of US President Donald Trump's administration's policies.

Technically, the bearish outlook for the DXY remains in place, as the index is holding below the key 100-day Exponential Moving Average (EMA) on the daily timeframe. The path of least resistance is to the downside as the 14-day Relative Strength Index (RSI), which is below the midline near 31.15, favors sellers in the near term. In a bearish event, the March 18 low of 103.20 acts as an initial support level for the USD index. The key level to watch is 102.00, which represents the psychological level and the lower boundary of the Bollinger Band. A sustained decline could lead to a drop to 100.53, the August 28, 2024 low.

On the upside, the immediate resistance level for the DXY comes in at 104.10, the March 14 high. Further north, the next hurdle is seen at 105.45, the November 6, 2024 high. Any follow-through buying above this level could lead to a rally to 106.10, the 100-day EMA.(Newsmaker23)

Source: FXstreet

The dollar slipped on Friday as a data-heavy week wound down, keeping the case for a September Federal Reserve interest rate cut intact, while traders awaited talks in Alaska between U.S. President Do...

The U.S. dollar slipped on Friday as investors remained cautious about the rate outlook ahead of import price data, after recent figures suggested inflation could accelerate in the coming months. The...

The U.S. dollar rose slightly against other major currencies on Thursday, but stayed close to multi-week lows as bets that the Federal Reserve will resume cutting interest rates next month ticked high...

The U.S. dollar was under pressure on Thursday as traders piled into wagers that the Federal Reserve will resume cutting interest rates next month, powering bitcoin to a record high, while a blisterin...

The dollar fell to a two-week low on Wednesday after a tame reading on U.S. inflation bolstered expectations of a Federal Reserve rate cut next month, with President Donald Trump's attempts to extend ...

Asia-Pacific markets traded mixed Monday , after the U.S.-Russia summit concluded without a ceasefire. Japan's Nikkei 225 benchmark rose 0.62%, while the broader Topix index added 0.42%. In South Korea, the Kospi index fell 1.06%, while the...

The Trump administration has expanded its 50% tariffs on steel and aluminum imports to cover hundreds of additional products. In a Federal Register notice on Friday, the Commerce Department's Bureau of Industry and Security said 407 new product...

Talks on a proposed U.S.-India trade deal have been delayed after a planned visit by American negotiators to New Delhi on August 25–29 was called off, Reuters reported. The move dashed hopes of easing fresh U.S. tariffs on Indian goods set to take...

The U.S. Census Bureau will release the country's Retail Sales report on Friday. Market analysts expect headline Retail Sales to grow 0.5% monthly...

The U.S. Census Bureau will release the country's Retail Sales report on Friday. Market analysts expect headline Retail Sales to grow 0.5% monthly...

Donald Trump and Vladimir Putin will measure success at their summit in Alaska very differently, even as both leaders are already...

Donald Trump and Vladimir Putin will measure success at their summit in Alaska very differently, even as both leaders are already...

Donald Trump and Vladimir Putin held talks in Alaska on Friday (August 15). The US president's hopes of reaching a ceasefire in Ukraine remain...

Donald Trump and Vladimir Putin held talks in Alaska on Friday (August 15). The US president's hopes of reaching a ceasefire in Ukraine remain...

Retail sales in the US increased 0.5% month-over-month in July 2025, in line with market expectations and following an upwardly revised 0.9% rise in...

Retail sales in the US increased 0.5% month-over-month in July 2025, in line with market expectations and following an upwardly revised 0.9% rise in...